12. Mean-Variance Portfolio Class¶

Without doubt, the Markowitz (1952) mean-variance portfolio theory is a cornerstone of modern financial theory. This section illustrates the use of the mean_variance_portfolio class to implement this approach.

[1]:

from dx import *

from pylab import plt

plt.style.use('seaborn')

12.1. Market Environment and Portfolio Object¶

We start by instantiating a market environment object which in particular contains a list of ticker symbols in which we are interested in.

[11]:

ma = market_environment('ma', dt.date(2010, 1, 1))

ma.add_list('symbols', ['AAPL.O', 'INTC.O', 'MSFT.O', 'GS.N'])

ma.add_constant('source', 'google')

ma.add_constant('final date', dt.date(2014, 3, 1))

Using pandas under the hood, the class retrieves historial stock price data from either Yahoo! Finance of Google.

[13]:

%%time

port = mean_variance_portfolio('am_tech_stocks', ma)

# instantiates the portfolio class

# and retrieves all the time series data needed

CPU times: user 16.1 ms, sys: 4.44 ms, total: 20.5 ms

Wall time: 179 ms

[14]:

port.get_available_symbols()

[14]:

Index(['AAPL.O', 'MSFT.O', 'INTC.O', 'AMZN.O', 'GS.N', 'SPY', '.SPX', '.VIX',

'EUR=', 'XAU=', 'GDX', 'GLD'],

dtype='object')

12.2. Basic Statistics¶

Since no portfolio weights have been provided, the class defaults to equal weights.

[15]:

port.get_weights()

# defaults to equal weights

[15]:

{'AAPL.O': 0.25, 'GS.N': 0.25, 'INTC.O': 0.25, 'MSFT.O': 0.25}

Given these weights you can calculate the portfolio return via the method get_portfolio_return.

[16]:

port.get_portfolio_return()

# expected (= historical mean) return

[16]:

0.12192541796457722

Analogously, you can call get_portfolio_variance to get the historical portfolio variance.

[17]:

port.get_portfolio_variance()

# expected (= historical) variance

[17]:

0.03365126396235786

The class also has a neatly printable string representation.

[18]:

print(port)

# ret. con. is "return contribution"

# given the mean return and the weight

# of the security

Portfolio am_tech_stocks

--------------------------

return 0.122

volatility 0.183

Sharpe ratio 0.665

Positions

symbol | weight | ret. con.

---------------------------

AAPL.O | 0.250 | 0.055

INTC.O | 0.250 | 0.025

MSFT.O | 0.250 | 0.032

GS.N | 0.250 | 0.011

12.3. Setting Weights¶

Via the method set_weights the weights of the single portfolio components can be adjusted.

[19]:

port.set_weights([0.6, 0.2, 0.1, 0.1])

[21]:

print(port)

Portfolio am_tech_stocks

--------------------------

return 0.168

volatility 0.201

Sharpe ratio 0.837

Positions

symbol | weight | ret. con.

---------------------------

AAPL.O | 0.600 | 0.131

INTC.O | 0.200 | 0.020

MSFT.O | 0.100 | 0.013

GS.N | 0.100 | 0.004

You cal also easily check results for different weights with changing the attribute values of an object.

[22]:

port.test_weights([0.6, 0.2, 0.1, 0.1])

# returns av. return + vol + Sharp ratio

# without setting new weights

[22]:

array([0.16804275, 0.20076851, 0.83699753])

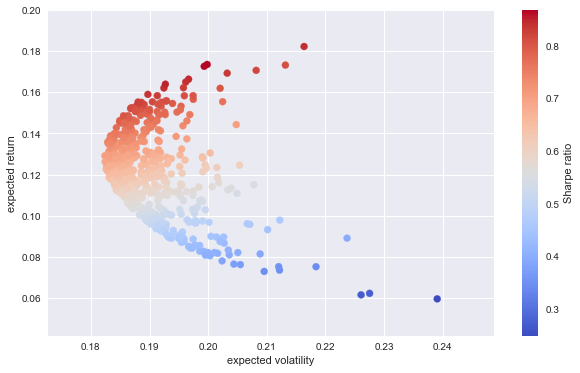

Let us implement a Monte Carlo simulation over potential portfolio weights.

[23]:

# Monte Carlo simulation of portfolio compositions

rets = []

vols = []

for w in range(500):

weights = np.random.random(4)

weights /= sum(weights)

r, v, sr = port.test_weights(weights)

rets.append(r)

vols.append(v)

rets = np.array(rets)

vols = np.array(vols)

And the simulation results visualized.

[29]:

import matplotlib.pyplot as plt

%matplotlib inline

plt.figure(figsize=(10, 6))

plt.scatter(vols, rets, c=rets / vols, marker='o', cmap='coolwarm')

plt.xlabel('expected volatility')

plt.ylabel('expected return')

plt.colorbar(label='Sharpe ratio');

12.4. Optimizing Portfolio Composition¶

One of the major application areas of the mean-variance portfolio theory and therewith of this DX Analytics class it the optimization of the portfolio composition. Different target functions can be used to this end.

12.4.1. Return¶

The first target function might be the portfolio return.

[30]:

port.optimize('Return')

# maximizes expected return of portfolio

# no volatility constraint

[31]:

print(port)

Portfolio am_tech_stocks

--------------------------

return 0.219

volatility 0.255

Sharpe ratio 0.858

Positions

symbol | weight | ret. con.

---------------------------

AAPL.O | 1.000 | 0.219

INTC.O | 0.000 | 0.000

MSFT.O | 0.000 | 0.000

GS.N | 0.000 | 0.000

Instead of maximizing the portfolio return without any constraints, you can also set a (sensible/possible) maximum target volatility level as a constraint. Both, in an exact sense (“equality constraint”) …

[32]:

port.optimize('Return', constraint=0.225, constraint_type='Exact')

# interpretes volatility constraint as equality

[33]:

print(port)

Portfolio am_tech_stocks

--------------------------

return 0.095

volatility 0.225

Sharpe ratio 0.421

Positions

symbol | weight | ret. con.

---------------------------

AAPL.O | 0.294 | 0.064

INTC.O | 0.000 | 0.000

MSFT.O | 0.000 | 0.000

GS.N | 0.706 | 0.030

… or just a an upper bound (“inequality constraint”).

[34]:

port.optimize('Return', constraint=0.4, constraint_type='Bound')

# interpretes volatility constraint as inequality (upper bound)

[35]:

print(port)

Portfolio am_tech_stocks

--------------------------

return 0.219

volatility 0.255

Sharpe ratio 0.858

Positions

symbol | weight | ret. con.

---------------------------

AAPL.O | 1.000 | 0.219

INTC.O | 0.000 | 0.000

MSFT.O | 0.000 | 0.000

GS.N | 0.000 | 0.000

12.4.2. Risk¶

The class also allows you to minimize portfolio risk.

[36]:

port.optimize('Vol')

# minimizes expected volatility of portfolio

# no return constraint

[37]:

print(port)

Portfolio am_tech_stocks

--------------------------

return 0.128

volatility 0.182

Sharpe ratio 0.702

Positions

symbol | weight | ret. con.

---------------------------

AAPL.O | 0.250 | 0.055

INTC.O | 0.275 | 0.027

MSFT.O | 0.305 | 0.039

GS.N | 0.169 | 0.007

And, as before, to set constraints (in this case) for the target return level.

[38]:

port.optimize('Vol', constraint=0.175, constraint_type='Exact')

# interpretes return constraint as equality

[39]:

print(port)

Portfolio am_tech_stocks

--------------------------

return 0.175

volatility 0.199

Sharpe ratio 0.879

Positions

symbol | weight | ret. con.

---------------------------

AAPL.O | 0.561 | 0.123

INTC.O | 0.118 | 0.012

MSFT.O | 0.321 | 0.041

GS.N | 0.000 | 0.000

[40]:

port.optimize('Vol', constraint=0.20, constraint_type='Bound')

# interpretes return constraint as inequality (upper bound)

[41]:

print(port)

Portfolio am_tech_stocks

--------------------------

return 0.200

volatility 0.225

Sharpe ratio 0.889

Positions

symbol | weight | ret. con.

---------------------------

AAPL.O | 0.798 | 0.174

INTC.O | 0.000 | 0.000

MSFT.O | 0.202 | 0.026

GS.N | 0.000 | 0.000

12.4.3. Sharpe Ratio¶

Often, the target of the portfolio optimization efforts is the so called Sharpe ratio. The mean_variance_portfolio class of DX Analytics assumes a risk-free rate of zero in this context.

[42]:

port.optimize('Sharpe')

# maximize Sharpe ratio

[43]:

print(port)

Portfolio am_tech_stocks

--------------------------

return 0.192

volatility 0.215

Sharpe ratio 0.893

Positions

symbol | weight | ret. con.

---------------------------

AAPL.O | 0.713 | 0.156

INTC.O | 0.000 | 0.000

MSFT.O | 0.287 | 0.036

GS.N | 0.000 | 0.000

12.5. Efficient Frontier¶

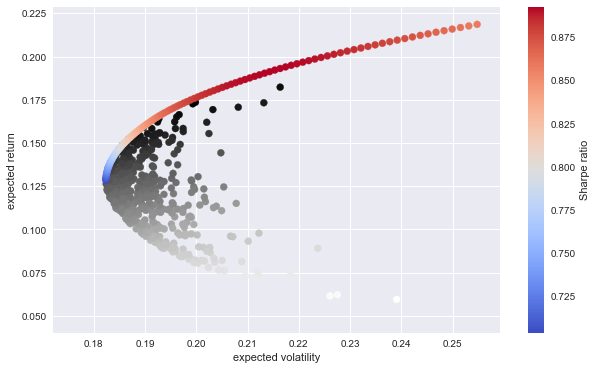

Another application area is to derive the efficient frontier in the mean-variance space. These are all these portfolios for which there is no portfolio with both lower risk and higher return. The method get_efficient_frontier yields the desired results.

[44]:

%%time

evols, erets = port.get_efficient_frontier(100)

# 100 points of the effient frontier

CPU times: user 4.24 s, sys: 10.8 ms, total: 4.25 s

Wall time: 4.25 s

The plot with the random and efficient portfolios.

[46]:

plt.figure(figsize=(10, 6))

plt.scatter(vols, rets, c=rets / vols, marker='o')

plt.scatter(evols, erets, c=erets / evols, marker='o', cmap='coolwarm')

plt.xlabel('expected volatility')

plt.ylabel('expected return')

plt.colorbar(label='Sharpe ratio')

[46]:

<matplotlib.colorbar.Colorbar at 0x10f8dc550>

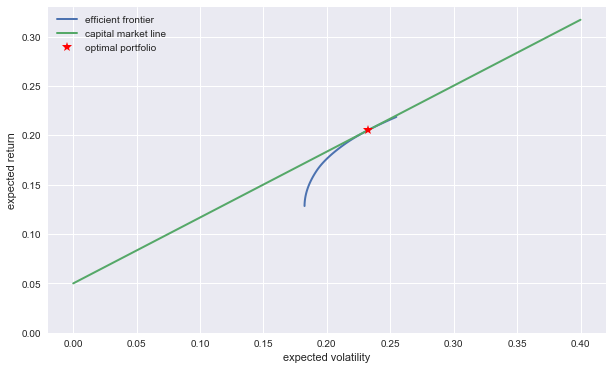

12.6. Capital Market Line¶

The capital market line is another key element of the mean-variance portfolio approach representing all those risk-return combinations (in mean-variance space) that are possible to form from a risk-less money market account and the market portfolio (or another appropriate substitute efficient portfolio).

[47]:

%%time

cml, optv, optr = port.get_capital_market_line(riskless_asset=0.05)

# capital market line for effiecient frontier and risk-less short rate

CPU times: user 4.04 s, sys: 4.81 ms, total: 4.05 s

Wall time: 4.05 s

[48]:

cml # lambda function for capital market line

[48]:

<function dx.portfolio.mean_variance_portfolio.get_capital_market_line.<locals>.<lambda>>

The following plot illustrates that the capital market line has an ordinate value equal to the risk-free rate (the safe return of the money market account) and is tangent to the efficient frontier.

[49]:

plt.figure(figsize=(10, 6))

plt.plot(evols, erets, lw=2.0, label='efficient frontier')

plt.plot((0, 0.4), (cml(0), cml(0.4)), lw=2.0, label='capital market line')

plt.plot(optv, optr, 'r*', markersize=10, label='optimal portfolio')

plt.legend(loc=0)

plt.ylim(0)

plt.xlabel('expected volatility')

plt.ylabel('expected return')

[49]:

<matplotlib.text.Text at 0x10f3809e8>

Portfolio return and risk of the efficient portfolio used are:

[50]:

optr

[50]:

0.20507680142118542

[51]:

optv

[51]:

0.23227456779433622

The portfolio composition can be derived as follows.

[52]:

port.optimize('Vol', constraint=optr, constraint_type='Exact')

[53]:

print(port)

Portfolio am_tech_stocks

--------------------------

return 0.205

volatility 0.232

Sharpe ratio 0.883

Positions

symbol | weight | ret. con.

---------------------------

AAPL.O | 0.853 | 0.186

INTC.O | 0.000 | 0.000

MSFT.O | 0.147 | 0.019

GS.N | 0.000 | 0.000

Or also in this way.

[54]:

port.optimize('Return', constraint=optv, constraint_type='Exact')

[55]:

print(port)

Portfolio am_tech_stocks

--------------------------

return 0.083

volatility 0.232

Sharpe ratio 0.357

Positions

symbol | weight | ret. con.

---------------------------

AAPL.O | 0.226 | 0.050

INTC.O | 0.000 | 0.000

MSFT.O | 0.000 | 0.000

GS.N | 0.774 | 0.033

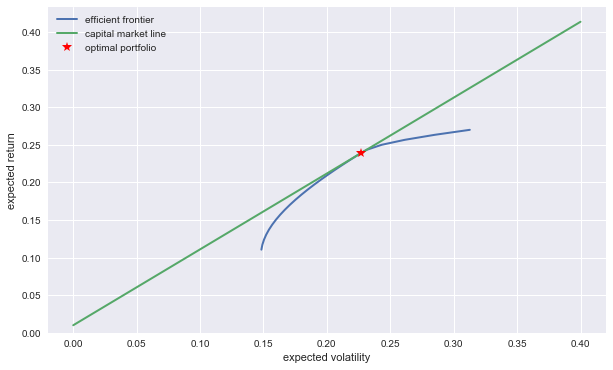

12.7. More Assets¶

As a larger, more realistic example, consider a larger set of assets.

[71]:

symbols = list(port.get_available_symbols())[:7]

symbols

[71]:

['AAPL.O', 'MSFT.O', 'INTC.O', 'AMZN.O', 'GS.N', 'SPY', '.SPX']

[72]:

ma = market_environment('ma', dt.date(2010, 1, 1))

ma.add_list('symbols', symbols)

ma.add_constant('source', 'google')

ma.add_constant('final date', dt.date(2014, 3, 1))

Data retrieval in this case takes a bit.

[73]:

%%time

djia = mean_variance_portfolio('djia', ma)

# defining the portfolio and retrieving the data

CPU times: user 14.2 ms, sys: 4.63 ms, total: 18.8 ms

Wall time: 212 ms

[74]:

%%time

djia.optimize('Vol')

print(djia.variance, djia.variance ** 0.5)

# minimium variance & volatility in decimals

0.021982829770393886 0.14826607761181884

CPU times: user 55.8 ms, sys: 1.83 ms, total: 57.6 ms

Wall time: 56.1 ms

Given the larger data set now used, efficient frontier …

[75]:

%%time

evols, erets = djia.get_efficient_frontier(25)

# efficient frontier of DJIA

CPU times: user 2.28 s, sys: 3.93 ms, total: 2.28 s

Wall time: 2.28 s

… and capital market line derivations take also longer.

[76]:

%%time

cml, optv, optr = djia.get_capital_market_line(riskless_asset=0.01)

# capital market line and optimal (tangent) portfolio

CPU times: user 8.4 s, sys: 6.07 ms, total: 8.4 s

Wall time: 8.4 s

[77]:

plt.figure(figsize=(10, 6))

plt.plot(evols, erets, lw=2.0, label='efficient frontier')

plt.plot((0, 0.4), (cml(0), cml(0.4)), lw=2.0, label='capital market line')

plt.plot(optv, optr, 'r*', markersize=10, label='optimal portfolio')

plt.legend(loc=0)

plt.ylim(0)

plt.xlabel('expected volatility')

plt.ylabel('expected return')

[77]:

<matplotlib.text.Text at 0x1103a70b8>

Copyright, License & Disclaimer

© Dr. Yves J. Hilpisch | The Python Quants GmbH

DX Analytics (the “dx library” or “dx package”) is licensed under the GNU Affero General Public License version 3 or later (see http://www.gnu.org/licenses/).

DX Analytics comes with no representations or warranties, to the extent permitted by applicable law.

http://tpq.io | dx@tpq.io | http://twitter.com/dyjh

Quant Platform | http://pqp.io

Python for Finance Training | http://training.tpq.io

Certificate in Computational Finance | http://compfinance.tpq.io

Derivatives Analytics with Python (Wiley Finance) | http://dawp.tpq.io

Python for Finance (2nd ed., O’Reilly) | http://py4fi.tpq.io