1. Quickstart¶

This brief first part illustrates—without much explanation—the usage of the DX Analytics library. It models two risk factors, two derivatives instruments and values these in a portfolio context.

[1]:

import dx

import datetime as dt

import pandas as pd

from pylab import plt

plt.style.use('seaborn')

1.1. Risk Factor Models¶

The first step is to define a model for the risk-neutral discounting.

[2]:

r = dx.constant_short_rate('r', 0.01)

We then define a market environment containing the major parameter specifications needed,

[3]:

me_1 = dx.market_environment('me', dt.datetime(2016, 1, 1))

[4]:

me_1.add_constant('initial_value', 100.)

# starting value of simulated processes

me_1.add_constant('volatility', 0.2)

# volatiltiy factor

me_1.add_constant('final_date', dt.datetime(2017, 6, 30))

# horizon for simulation

me_1.add_constant('currency', 'EUR')

# currency of instrument

me_1.add_constant('frequency', 'W')

# frequency for discretization

me_1.add_constant('paths', 10000)

# number of paths

me_1.add_curve('discount_curve', r)

# number of paths

Next, the model object for the first risk factor, based on the geometric Brownian motion (Black-Scholes-Merton (1973) model).

[5]:

gbm_1 = dx.geometric_brownian_motion('gbm_1', me_1)

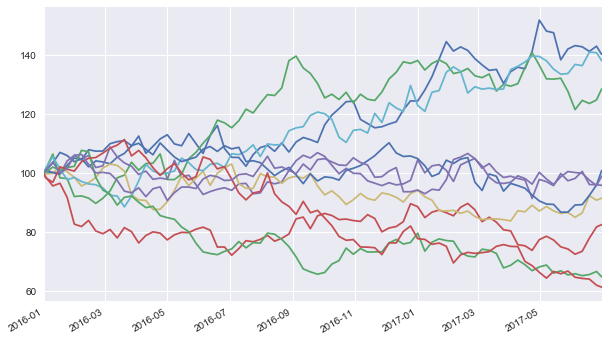

Some paths visualized.

[6]:

pdf = pd.DataFrame(gbm_1.get_instrument_values(), index=gbm_1.time_grid)

[7]:

%matplotlib inline

pdf.iloc[:, :10].plot(legend=False, figsize=(10, 6));

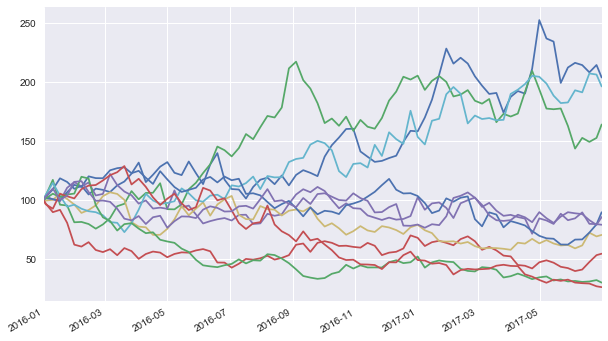

Second risk factor with higher volatility. We overwrite the respective value in the market environment.

[8]:

me_2 = dx.market_environment('me_2', me_1.pricing_date)

me_2.add_environment(me_1) # add complete environment

me_2.add_constant('volatility', 0.5) # overwrite value

[9]:

gbm_2 = dx.geometric_brownian_motion('gbm_2', me_2)

[10]:

pdf = pd.DataFrame(gbm_2.get_instrument_values(), index=gbm_2.time_grid)

[11]:

pdf.iloc[:, :10].plot(legend=False, figsize=(10, 6));

1.2. Valuation Models¶

Based on the risk factors, we can then define derivatives models for valuation. To this end, we need to add at least one (the maturity), in general two (maturity and strike), parameters to the market environments.

[12]:

me_opt = dx.market_environment('me_opt', me_1.pricing_date)

me_opt.add_environment(me_1)

me_opt.add_constant('maturity', dt.datetime(2017, 6, 30))

me_opt.add_constant('strike', 110.)

The first derivative is an American put option on the first risk factor gbm_1.

[13]:

am_put = dx.valuation_mcs_american_single(

name='am_put',

underlying=gbm_1,

mar_env=me_opt,

payoff_func='np.maximum(strike - instrument_values, 0)')

Let us calculate a Monte Carlo present value estimate and estimates for the option Greeks.

[14]:

am_put.present_value()

[14]:

15.013

[15]:

am_put.delta()

[15]:

-0.5411

[16]:

am_put.gamma()

[16]:

-0.0082

[17]:

am_put.vega()

[17]:

51.1584

[18]:

am_put.theta()

[18]:

-3.7421

[19]:

am_put.rho()

[19]:

-71.1355

The second derivative is a European call option on the second risk factor gbm_2.

[20]:

eur_call = dx.valuation_mcs_european_single(

name='eur_call',

underlying=gbm_2,

mar_env=me_opt,

payoff_func='np.maximum(maturity_value - strike, 0)')

Valuation and Greek estimation for this option.

[21]:

eur_call.present_value()

[21]:

20.641978

[22]:

eur_call.delta()

[22]:

0.8496

[23]:

eur_call.gamma()

[23]:

0.0057

[24]:

eur_call.vega()

[24]:

48.2888

[25]:

eur_call.theta()

[25]:

-8.7493

[26]:

eur_call.rho()

[26]:

54.3995

1.3. Excursion: SABR Model¶

To illustrate how general the approach of DX Analytics is, let us quickly analyze an option based on a SABR stochastic volatility process. In what follows herafter, the SABR model does not play a role.

We need to define different parameters obviously.

[27]:

me_3 = dx.market_environment('me_3', me_1.pricing_date)

me_3.add_environment(me_1) # add complete environment

[28]:

# interest rate like parmeters

me_3.add_constant('initial_value', 0.05)

# initial value

me_3.add_constant('alpha', 0.1)

# initial variance

me_3.add_constant('beta', 0.5)

# exponent

me_3.add_constant('rho', 0.1)

# correlation factor

me_3.add_constant('vol_vol', 0.5)

# volatility of volatility/variance

The model object instantiation.

[29]:

sabr = dx.sabr_stochastic_volatility('sabr', me_3)

The valuation object instantiation.

[30]:

me_opt.add_constant('strike', me_3.get_constant('initial_value'))

[31]:

sabr_call = dx.valuation_mcs_european_single(

name='sabr_call',

underlying=sabr,

mar_env=me_opt,

payoff_func='np.maximum(maturity_value - strike, 0)')

Some statistics — same syntax/API even if the model is more complex.

[32]:

sabr_call.present_value(fixed_seed=True)

[32]:

0.025849

[33]:

sabr_call.delta()

[33]:

0.8151

[34]:

sabr_call.rho()

[34]:

-0.0385

[35]:

# resetting the option strike

me_opt.add_constant('strike', 110.)

1.4. Options Portfolio¶

1.4.1. Modeling¶

In a portfolio context, we need to add information about the model class(es) to be used to the market environments of the risk factors.

[36]:

me_1.add_constant('model', 'gbm')

me_2.add_constant('model', 'gbm')

To compose a portfolio consisting of our just defined options, we need to define derivatives positions. Note that this step is independent from the risk factor model and option model definitions. We only use the market environment data and some additional information needed (e.g. payoff functions).

[37]:

put = dx.derivatives_position(

name='put',

quantity=2,

underlyings=['gbm_1'],

mar_env=me_opt,

otype='American single',

payoff_func='np.maximum(strike - instrument_values, 0)')

[38]:

call = dx.derivatives_position(

name='call',

quantity=3,

underlyings=['gbm_2'],

mar_env=me_opt,

otype='European single',

payoff_func='np.maximum(maturity_value - strike, 0)')

Let us define the relevant market by 2 Python dictionaries, the correlation between the two risk factors and a valuation environment.

[39]:

risk_factors = {'gbm_1': me_1, 'gbm_2' : me_2}

correlations = [['gbm_1', 'gbm_2', -0.4]]

positions = {'put' : put, 'call' : call}

[40]:

val_env = dx.market_environment('general', dt.datetime(2016, 1, 1))

val_env.add_constant('frequency', 'W')

val_env.add_constant('paths', 10000)

val_env.add_constant('starting_date', val_env.pricing_date)

val_env.add_constant('final_date', val_env.pricing_date)

val_env.add_curve('discount_curve', r)

These are used to define the derivatives portfolio.

[41]:

port = dx.derivatives_portfolio(

name='portfolio', # name

positions=positions, # derivatives positions

val_env=val_env, # valuation environment

risk_factors=risk_factors, # relevant risk factors

correlations=correlations, # correlation between risk factors

parallel=False) # parallel valuation

1.4.2. Simulation and Valuation¶

Now, we can get the position values for the portfolio via the get_values method.

[42]:

port.get_values()

Total

pos_value 91.269955

dtype: float64

[42]:

| position | name | quantity | otype | risk_facts | value | currency | pos_value | |

|---|---|---|---|---|---|---|---|---|

| 0 | put | put | 2 | American single | [gbm_1] | 15.029000 | EUR | 30.058000 |

| 1 | call | call | 3 | European single | [gbm_2] | 20.403985 | EUR | 61.211955 |

Via the get_statistics methods delta and vega values are provided as well.

[43]:

port.get_statistics()

Totals

pos_value 91.2700

pos_delta 0.5310

pos_vega 225.1372

dtype: float64

[43]:

| position | name | quantity | otype | risk_facts | value | currency | pos_value | pos_delta | pos_vega | |

|---|---|---|---|---|---|---|---|---|---|---|

| 0 | put | put | 2 | American single | [gbm_1] | 15.029 | EUR | 30.058 | -1.1802 | 87.3484 |

| 1 | call | call | 3 | European single | [gbm_2] | 20.404 | EUR | 61.212 | 1.7112 | 137.7888 |

Much more complex scenarios are possible with DX Analytics

1.4.3. Risk Reports¶

Having modeled the derivatives portfolio, risk reports are only two method calls away.

[44]:

deltas, benchvalue = port.get_port_risk(Greek='Delta')

gbm_2

0.8

0.9

1.0

1.1

1.2

gbm_1

0.8

0.9

1.0

1.1

1.2

[45]:

deltas

[45]:

| gbm_2_Delta | gbm_1_Delta | ||

|---|---|---|---|

| major | minor | ||

| 0.8 | factor | 80.000000 | 80.000000 |

| value | 61.767112 | 122.001955 | |

| 0.9 | factor | 90.000000 | 90.000000 |

| value | 75.421234 | 104.903955 | |

| 1.0 | factor | 100.000000 | 100.000000 |

| value | 91.269955 | 91.269955 | |

| 1.1 | factor | 110.000000 | 110.000000 |

| value | 109.161973 | 80.751955 | |

| 1.2 | factor | 120.000000 | 120.000000 |

| value | 128.739235 | 73.195955 |

[46]:

deltas.loc(axis=0)[:, 'value'] - benchvalue

[46]:

| gbm_2_Delta | gbm_1_Delta | ||

|---|---|---|---|

| major | minor | ||

| 0.8 | value | -29.502843 | 30.732 |

| 0.9 | value | -15.848721 | 13.634 |

| 1.0 | value | 0.000000 | 0.000 |

| 1.1 | value | 17.892018 | -10.518 |

| 1.2 | value | 37.469280 | -18.074 |

[47]:

vegas, benchvalue = port.get_port_risk(Greek='Vega', step=0.05)

gbm_2

0.8

0.8500000000000001

0.9000000000000001

0.9500000000000002

1.0000000000000002

1.0500000000000003

1.1000000000000003

1.1500000000000004

1.2000000000000004

gbm_1

0.8

0.8500000000000001

0.9000000000000001

0.9500000000000002

1.0000000000000002

1.0500000000000003

1.1000000000000003

1.1500000000000004

1.2000000000000004

[48]:

vegas

[48]:

| gbm_2_Vega | gbm_1_Vega | ||

|---|---|---|---|

| major | minor | ||

| 0.80 | factor | 0.400000 | 0.160000 |

| value | 77.334907 | 87.597955 | |

| 0.85 | factor | 0.430000 | 0.170000 |

| value | 80.843542 | 88.473955 | |

| 0.90 | factor | 0.450000 | 0.180000 |

| value | 84.336475 | 89.377955 | |

| 0.95 | factor | 0.480000 | 0.190000 |

| value | 87.812380 | 90.351955 | |

| 1.00 | factor | 0.500000 | 0.200000 |

| value | 91.269955 | 91.269955 | |

| 1.05 | factor | 0.530000 | 0.210000 |

| value | 94.708426 | 92.143955 | |

| 1.10 | factor | 0.550000 | 0.220000 |

| value | 98.125972 | 93.137955 | |

| 1.15 | factor | 0.580000 | 0.230000 |

| value | 101.519533 | 94.045955 | |

| 1.20 | factor | 0.600000 | 0.240000 |

| value | 104.887072 | 95.013955 |

[49]:

vegas.loc(axis=0)[:, 'value'] - benchvalue

[49]:

| gbm_2_Vega | gbm_1_Vega | ||

|---|---|---|---|

| major | minor | ||

| 0.80 | value | -13.935048 | -3.672 |

| 0.85 | value | -10.426413 | -2.796 |

| 0.90 | value | -6.933480 | -1.892 |

| 0.95 | value | -3.457575 | -0.918 |

| 1.00 | value | 0.000000 | 0.000 |

| 1.05 | value | 3.438471 | 0.874 |

| 1.10 | value | 6.856017 | 1.868 |

| 1.15 | value | 10.249578 | 2.776 |

| 1.20 | value | 13.617117 | 3.744 |

Copyright, License & Disclaimer

© Dr. Yves J. Hilpisch | The Python Quants GmbH

DX Analytics (the “dx library” or “dx package”) is licensed under the GNU Affero General Public License version 3 or later (see http://www.gnu.org/licenses/).

DX Analytics comes with no representations or warranties, to the extent permitted by applicable law.

http://tpq.io | dx@tpq.io | http://twitter.com/dyjh

Quant Platform | http://pqp.io

Python for Finance Training | http://training.tpq.io

Certificate in Computational Finance | http://compfinance.tpq.io

Derivatives Analytics with Python (Wiley Finance) | http://dawp.tpq.io

Python for Finance (2nd ed., O’Reilly) | http://py4fi.tpq.io