5. Multi-Risk Derivatives Valuation¶

A specialty of DX Analytics is the valuation of derivatives instruments defined on multiple risk factors and portfolios composed of such derivatives. This section of the documentation illustrates the usage of the dedicated multi-risk valuation classes.

[1]:

from dx import *

from pylab import plt

plt.style.use('seaborn')

[2]:

import time

t0 = time.time()

There are the following multiple risk factor valuation classes available:

valuation_mcs_european_multifor the valuation of multi-risk derivatives with European exercisevaluation_mcs_american_multifor the valuation of multi-risk derivatives with American exercise

The handling of these classes is similar to building a portfolio of single-risk derivatives positions.

5.1. Market Environments¶

Market environments for the risk factors are the starting point.

[3]:

r = constant_short_rate('r', 0.06)

[4]:

me1 = market_environment('me1', dt.datetime(2015, 1, 1))

me2 = market_environment('me2', dt.datetime(2015, 1, 1))

[5]:

me1.add_constant('initial_value', 36.)

me1.add_constant('volatility', 0.1) # low volatility

me1.add_constant('currency', 'EUR')

me1.add_constant('model', 'gbm')

[6]:

me2.add_environment(me1)

me2.add_constant('initial_value', 36.)

me2.add_constant('volatility', 0.5) # high volatility

We assum a positive correlation between the two risk factors.

[7]:

risk_factors = {'gbm1' : me1, 'gbm2' : me2}

correlations = [['gbm1', 'gbm2', 0.5]]

5.2. Valuation Environment¶

Similar to the instantiation of a derivatives_portfolio object, a valuation environment is needed (unifying certain parameters/assumptions for all relevant risk factors of a derivative).

[8]:

val_env = market_environment('val_env', dt.datetime(2015, 1, 1))

[9]:

val_env.add_constant('starting_date', val_env.pricing_date)

val_env.add_constant('final_date', dt.datetime(2015, 12, 31))

val_env.add_constant('frequency', 'W')

val_env.add_constant('paths', 5000)

val_env.add_curve('discount_curve', r)

val_env.add_constant('maturity', dt.datetime(2015, 12, 31))

val_env.add_constant('currency', 'EUR')

5.3. valuation_mcs_european_multi¶

As an example for a multi-risk derivative with European exercise consider a maximum call option. With multiple risk factors, payoff functions are defined by adding key (the name strings) to the maturity_value array object. As with the portfolio valuation class, the multi-risk factor valuation classes get passed market_environment objects only and not the risk factor model objects themsemselves.

[10]:

# European maximum call option

payoff_func = "np.maximum(np.maximum(maturity_value['gbm1'], maturity_value['gbm2']) - 38, 0)"

vc = valuation_mcs_european_multi(

name='European maximum call', # name

val_env=val_env, # valuation environment

risk_factors=risk_factors, # the relevant risk factors

correlations=correlations, # correlations between risk factors

payoff_func=payoff_func) # payoff function

[11]:

vc.risk_factors

[11]:

{'gbm1': <dx.frame.market_environment at 0x114a74978>,

'gbm2': <dx.frame.market_environment at 0x114a74940>}

At instantiation, the respective risk factor model objects are instantiated as well.

[12]:

vc.underlying_objects

[12]:

{'gbm1': <dx.models.geometric_brownian_motion.geometric_brownian_motion at 0x114a6d320>,

'gbm2': <dx.models.geometric_brownian_motion.geometric_brownian_motion at 0x114a3d358>}

Correlations are stored as well and the resulting corrleation and Cholesky matrices are generated.

[13]:

vc.correlations

[13]:

[['gbm1', 'gbm2', 0.5]]

[14]:

vc.correlation_matrix

[14]:

| gbm1 | gbm2 | |

|---|---|---|

| gbm1 | 1.0 | 0.5 |

| gbm2 | 0.5 | 1.0 |

[15]:

vc.val_env.get_list('cholesky_matrix')

[15]:

array([[1. , 0. ],

[0.5 , 0.8660254]])

The payoff of a European option is a one-dimensional ndarray object.

[16]:

np.shape(vc.generate_payoff())

[16]:

(5000,)

Present value estimations are generated by a call of the present_value method.

[17]:

vc.present_value()

[17]:

7.846

The update method allows updating of certain parameters.

[18]:

vc.update('gbm1', initial_value=50.)

[19]:

vc.present_value()

[19]:

16.846

[20]:

vc.update('gbm2', volatility=0.6)

[21]:

vc.present_value()

[21]:

18.144

Let us reset the values to the original parameters.

[22]:

vc.update('gbm1', initial_value=36., volatility=0.1)

vc.update('gbm2', initial_value=36., volatility=0.5)

When calculating Greeks the risk factor, depending on the specific statistic required, now has to be specified by providing its name.

[23]:

vc.delta('gbm2', interval=0.5)

[23]:

0.5773

[24]:

vc.gamma('gbm2')

[24]:

0.0239

[25]:

vc.dollar_gamma('gbm2')

[25]:

15.4872

[26]:

vc.vega('gbm1')

[26]:

6.1892

[27]:

vc.theta()

[27]:

-5.9229

[28]:

vc.rho(interval=0.1)

[28]:

25.6032

[29]:

val_env.curves['discount_curve'].short_rate

[29]:

0.06

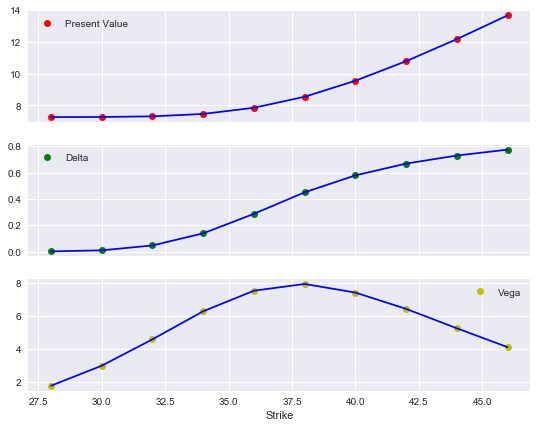

5.3.1. Sensitivities Positive Correlation¶

Almos in complete analogy to the single-risk valuation classes, sensitivities can be estimated for the multi-risk valuation classes.

5.3.2.1. Sensitivities Risk Factor 1¶

Consider first the case from before with positive correlation between the two risk factors. The following estimates and plots the sensitivities for the first risk factor ``gbm1``.

[30]:

%%time

s_list = np.arange(28., 46.1, 2.)

pv = []; de = []; ve = []

for s in s_list:

vc.update('gbm1', initial_value=s)

pv.append(vc.present_value())

de.append(vc.delta('gbm1', .5))

ve.append(vc.vega('gbm1', 0.2))

vc.update('gbm1', initial_value=36.)

CPU times: user 236 ms, sys: 2.73 ms, total: 239 ms

Wall time: 238 ms

[31]:

%matplotlib inline

[32]:

plot_option_stats(s_list, pv, de, ve)

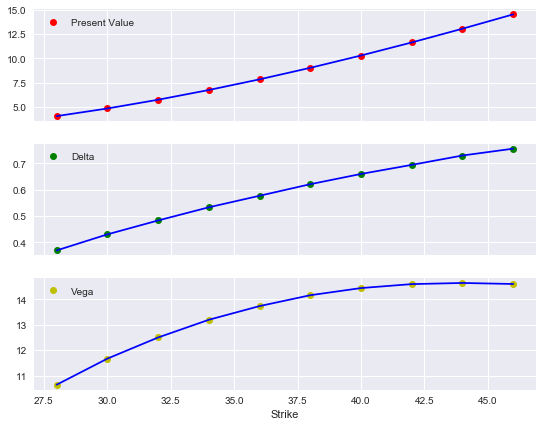

5.3.2.2. Sensitivities Risk Factor 2¶

Now the sensitivities for the second risk factor.

[33]:

%%time

s_list = np.arange(28., 46.1, 2.)

pv = []; de = []; ve = []

for s in s_list:

vc.update('gbm2', initial_value=s)

pv.append(vc.present_value())

de.append(vc.delta('gbm2', .5))

ve.append(vc.vega('gbm2', 0.2))

CPU times: user 230 ms, sys: 2.19 ms, total: 232 ms

Wall time: 231 ms

[34]:

plot_option_stats(s_list, pv, de, ve)

5.3.2. Sensitivities with Negative Correlation¶

The second case is for highly negatively correlated risk factors.

[35]:

correlations = [['gbm1', 'gbm2', -0.9]]

[36]:

# European maximum call option

payoff_func = "np.maximum(np.maximum(maturity_value['gbm1'], maturity_value['gbm2']) - 38, 0)"

vc = valuation_mcs_european_multi(

name='European maximum call',

val_env=val_env,

risk_factors=risk_factors,

correlations=correlations,

payoff_func=payoff_func)

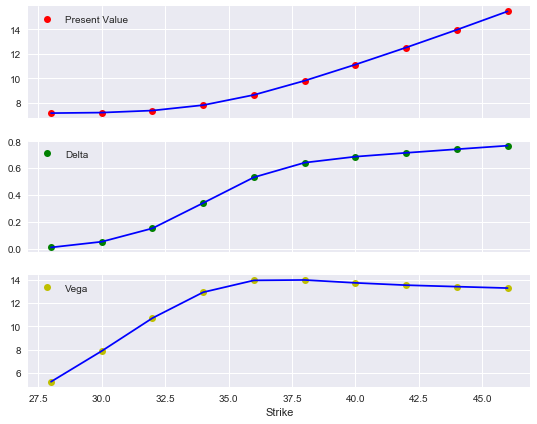

5.3.2.1. Sensitivities Risk Factor 1¶

Again, sensitivities for the first risk factor first.

[37]:

%%time

s_list = np.arange(28., 46.1, 2.)

pv = []; de = []; ve = []

for s in s_list:

vc.update('gbm1', initial_value=s)

pv.append(vc.present_value())

de.append(vc.delta('gbm1', .5))

ve.append(vc.vega('gbm1', 0.2))

vc.update('gbm1', initial_value=36.)

CPU times: user 239 ms, sys: 2.18 ms, total: 241 ms

Wall time: 240 ms

[38]:

plot_option_stats(s_list, pv, de, ve)

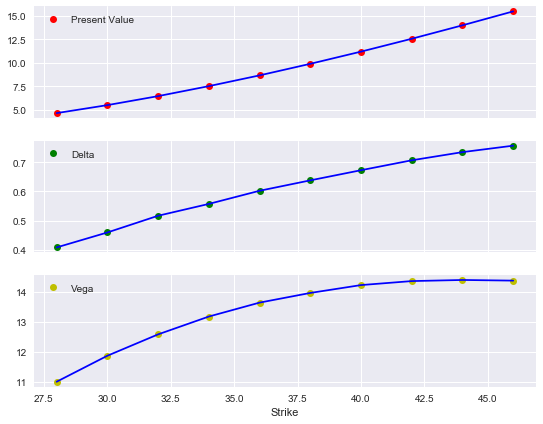

5.3.2.2. Sensitivities Risk Factor 2¶

Finally, the sensitivities for the second risk factor for this second scenario.

[39]:

%%time

s_list = np.arange(28., 46.1, 2.)

pv = []; de = []; ve = []

for s in s_list:

vc.update('gbm2', initial_value=s)

pv.append(vc.present_value())

de.append(vc.delta('gbm2', .5))

ve.append(vc.vega('gbm2', 0.2))

CPU times: user 234 ms, sys: 2.21 ms, total: 236 ms

Wall time: 235 ms

[40]:

plot_option_stats(s_list, pv, de, ve)

5.3.3. Surfaces for Positive Correlation Case¶

Let us return to the case of positive correlation between the two relevant risk factors.

[41]:

correlations = [['gbm1', 'gbm2', 0.5]]

[42]:

# European maximum call option

payoff_func = "np.maximum(np.maximum(maturity_value['gbm1'], maturity_value['gbm2']) - 38, 0)"

vc = valuation_mcs_european_multi(

name='European maximum call',

val_env=val_env,

risk_factors=risk_factors,

correlations=correlations,

payoff_func=payoff_func)

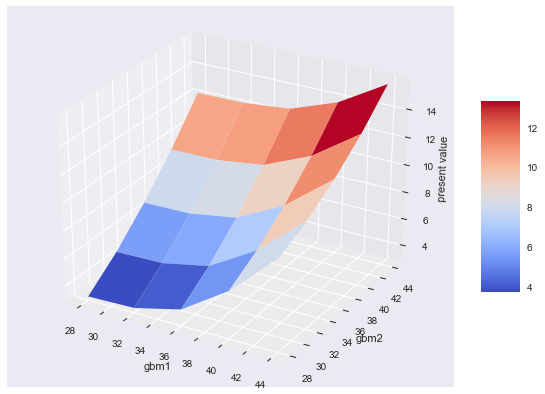

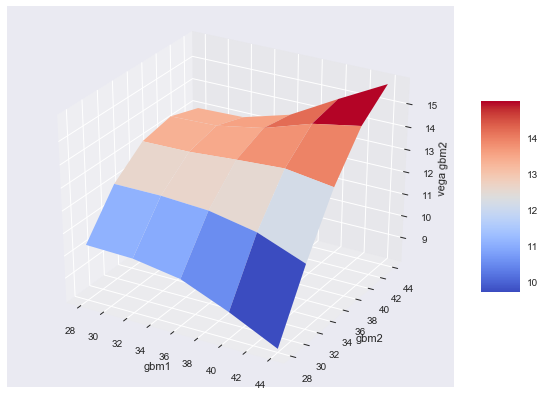

5.3.3.1. Value Surface¶

We are now interested in the value surface of the derivative instrument for both different initial values of the first and second risk factor.

[43]:

asset_1 = np.arange(28., 46.1, 4.) # range of initial values

asset_2 = asset_1

a_1, a_2 = np.meshgrid(asset_1, asset_2)

# two-dimensional grids out of the value vectors

value = np.zeros_like(a_1)

The following estimates for all possible combinations of the initial values—given the assumptions from above—the present value of the European maximum call option.

[44]:

%%time

for i in range(np.shape(value)[0]):

for j in range(np.shape(value)[1]):

vc.update('gbm1', initial_value=a_1[i, j])

vc.update('gbm2', initial_value=a_2[i, j])

value[i, j] = vc.present_value()

CPU times: user 265 ms, sys: 1.63 ms, total: 267 ms

Wall time: 266 ms

The resulting plot then looks as follows. Here, a helper plot function of DX Analytics is used.

[45]:

plot_greeks_3d([a_1, a_2, value], ['gbm1', 'gbm2', 'present value'])

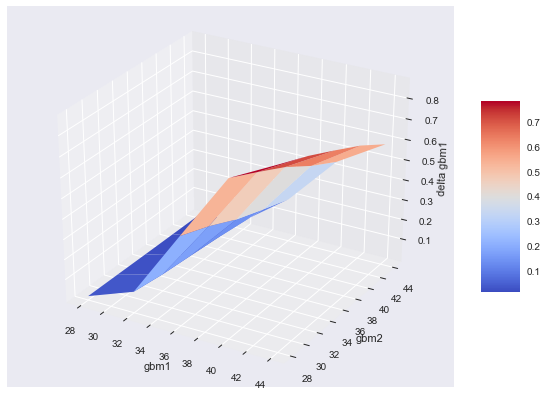

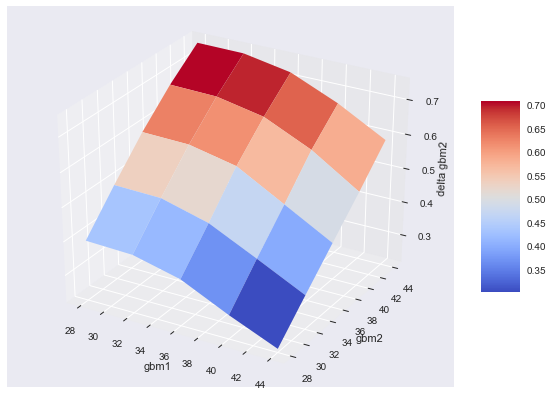

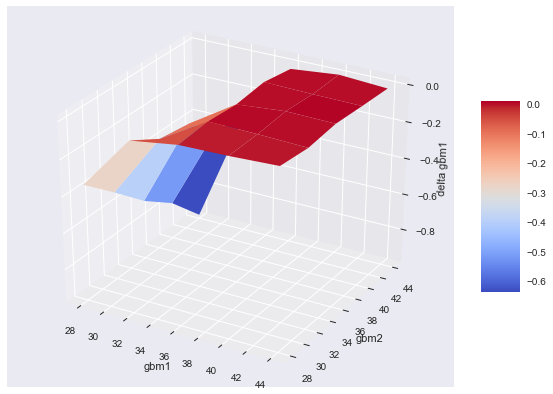

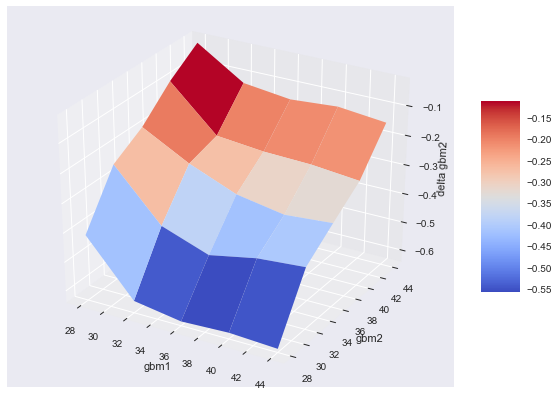

5.4.2. Delta Surfaces¶

Applying a very similar approach, a delta surface for all possible combinations of the intial values is as easily generated.

[46]:

delta_1 = np.zeros_like(a_1)

delta_2 = np.zeros_like(a_1)

[47]:

%%time

for i in range(np.shape(delta_1)[0]):

for j in range(np.shape(delta_1)[1]):

vc.update('gbm1', initial_value=a_1[i, j])

vc.update('gbm2', initial_value=a_2[i, j])

delta_1[i, j] = vc.delta('gbm1')

delta_2[i, j] = vc.delta('gbm2')

CPU times: user 757 ms, sys: 2.76 ms, total: 760 ms

Wall time: 760 ms

The plot for the delta surface of the first risk factor.

[48]:

plot_greeks_3d([a_1, a_2, delta_1], ['gbm1', 'gbm2', 'delta gbm1'])

And the plot for the delta of the second risk factor.

[49]:

plot_greeks_3d([a_1, a_2, delta_2], ['gbm1', 'gbm2', 'delta gbm2'])

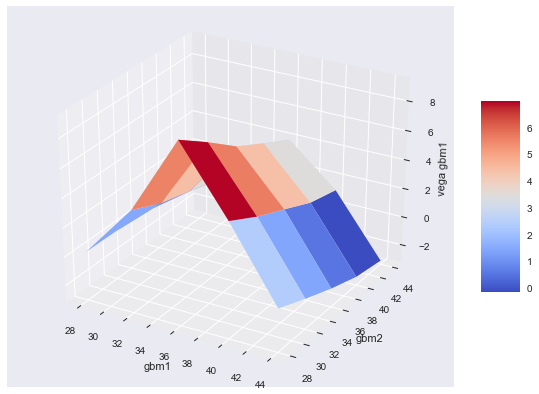

5.4.3. Vega Surfaces¶

The same approach can of course be applied to generate vega surfaces.

[50]:

vega_1 = np.zeros_like(a_1)

vega_2 = np.zeros_like(a_1)

[51]:

for i in range(np.shape(vega_1)[0]):

for j in range(np.shape(vega_1)[1]):

vc.update('gbm1', initial_value=a_1[i, j])

vc.update('gbm2', initial_value=a_2[i, j])

vega_1[i, j] = vc.vega('gbm1')

vega_2[i, j] = vc.vega('gbm2')

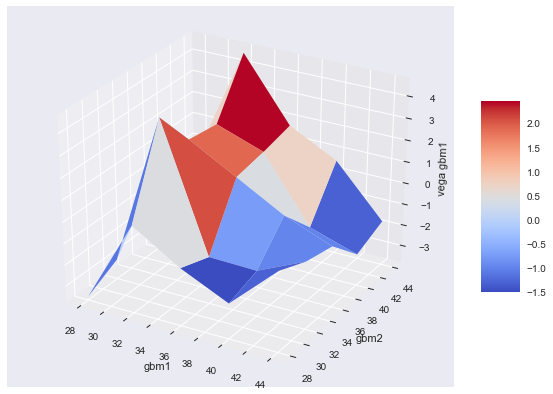

The surface for the first risk factor.

[52]:

plot_greeks_3d([a_1, a_2, vega_1], ['gbm1', 'gbm2', 'vega gbm1'])

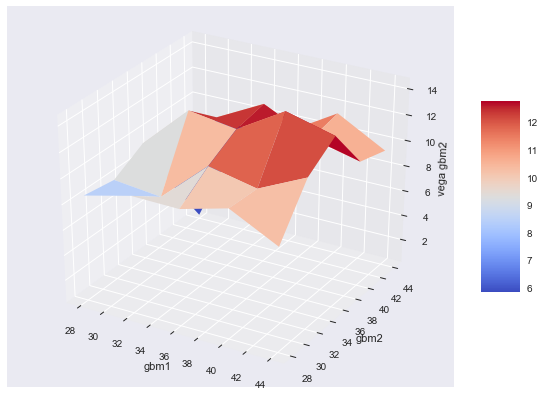

And the one for the second risk factor.

[53]:

plot_greeks_3d([a_1, a_2, vega_2], ['gbm1', 'gbm2', 'vega gbm2'])

Finally, we reset the intial values and the volatilities for the two risk factors.

[54]:

# restore initial values

vc.update('gbm1', initial_value=36., volatility=0.1)

vc.update('gbm2', initial_value=36., volatility=0.5)

5.4. valuation_mcs_american_multi¶

In general, the modeling and handling of the valuation classes for American exercise is not too different from those for European exercise. The major difference is in the definition of payoff function.

5.4.1. Present Values¶

This example models an American minimum put on the two risk factors from before.

[55]:

# American put payoff

payoff_am = "np.maximum(34 - np.minimum(instrument_values['gbm1'], instrument_values['gbm2']), 0)"

# finer time grid and more paths

val_env.add_constant('frequency', 'B')

val_env.add_curve('time_grid', None)

# delete existing time grid information

val_env.add_constant('paths', 5000)

[56]:

# American put option on minimum of two assets

vca = valuation_mcs_american_multi(

name='American minimum put',

val_env=val_env,

risk_factors=risk_factors,

correlations=correlations,

payoff_func=payoff_am)

[57]:

vca.present_value()

[57]:

4.607

[58]:

matrix={'gbm1': np.array([ 33.8899222 , 39.25932511]),

'gbm1gbm1': np.array([ 1148.52682654, 1541.29460798])}

[59]:

matrix

[59]:

{'gbm1': array([33.8899222 , 39.25932511]),

'gbm1gbm1': array([1148.52682654, 1541.29460798])}

[60]:

np.array(list(matrix.values())).T

[60]:

array([[ 33.8899222 , 1148.52682654],

[ 39.25932511, 1541.29460798]])

[61]:

for key, obj in vca.instrument_values.items():

print(np.shape(vca.instrument_values[key]))

(261, 5000)

(261, 5000)

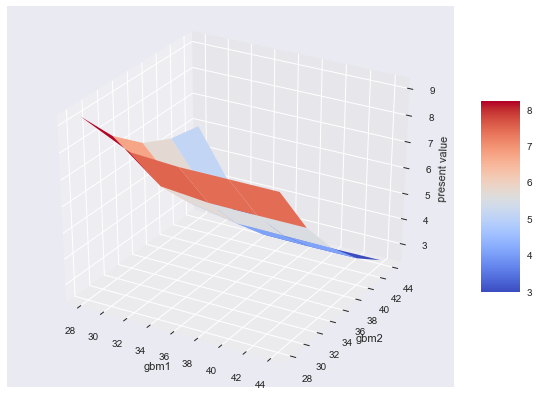

The present value surface is generated in the same way as before for the European option on the two risk factors. The computational burden is of course much higher for the American option, which are valued by the use of the Least-Squares Monte Carlo approach (LSM) according to Longstaff-Schwartz (2001).

[62]:

asset_1 = np.arange(28., 44.1, 4.)

asset_2 = asset_1

a_1, a_2 = np.meshgrid(asset_1, asset_2)

value = np.zeros_like(a_1)

[63]:

%%time

for i in range(np.shape(value)[0]):

for j in range(np.shape(value)[1]):

vca.update('gbm1', initial_value=a_1[i, j])

vca.update('gbm2', initial_value=a_2[i, j])

value[i, j] = vca.present_value()

CPU times: user 4.41 s, sys: 202 ms, total: 4.61 s

Wall time: 4.62 s

[64]:

plot_greeks_3d([a_1, a_2, value], ['gbm1', 'gbm2', 'present value'])

5.4.2. Delta Surfaces¶

The same exercise as before for the two delta surfaces.

[65]:

delta_1 = np.zeros_like(a_1)

delta_2 = np.zeros_like(a_1)

[66]:

%%time

for i in range(np.shape(delta_1)[0]):

for j in range(np.shape(delta_1)[1]):

vca.update('gbm1', initial_value=a_1[i, j])

vca.update('gbm2', initial_value=a_2[i, j])

delta_1[i, j] = vca.delta('gbm1')

delta_2[i, j] = vca.delta('gbm2')

CPU times: user 16.7 s, sys: 730 ms, total: 17.4 s

Wall time: 17.4 s

[67]:

plot_greeks_3d([a_1, a_2, delta_1], ['gbm1', 'gbm2', 'delta gbm1'])

[68]:

plot_greeks_3d([a_1, a_2, delta_2], ['gbm1', 'gbm2', 'delta gbm2'])

5.4.3. Vega Surfaces¶

And finally for the vega surfaces.

[69]:

vega_1 = np.zeros_like(a_1)

vega_2 = np.zeros_like(a_1)

[70]:

%%time

for i in range(np.shape(vega_1)[0]):

for j in range(np.shape(vega_1)[1]):

vca.update('gbm1', initial_value=a_1[i, j])

vca.update('gbm2', initial_value=a_2[i, j])

vega_1[i, j] = vca.vega('gbm1')

vega_2[i, j] = vca.vega('gbm2')

CPU times: user 17.5 s, sys: 747 ms, total: 18.3 s

Wall time: 18.4 s

[71]:

plot_greeks_3d([a_1, a_2, vega_1], ['gbm1', 'gbm2', 'vega gbm1'])

[72]:

plot_greeks_3d([a_1, a_2, vega_2], ['gbm1', 'gbm2', 'vega gbm2'])

5.5. More than Two Risk Factors¶

The principles of working with multi-risk valuation classes can be illustrated quite well in the two risk factor case. However, there is—in theory—no limitation on the number of risk factors used for derivatives modeling.

5.5.1. Four Asset Basket Option¶

Consider a maximum basket option on four different risk factors. We add a jump diffusion as well as a stochastic volatility model to the mix

[73]:

me3 = market_environment('me3', dt.datetime(2015, 1, 1))

me4 = market_environment('me4', dt.datetime(2015, 1, 1))

[74]:

me3.add_environment(me1)

me4.add_environment(me1)

[75]:

# for jump-diffusion

me3.add_constant('lambda', 0.5)

me3.add_constant('mu', -0.6)

me3.add_constant('delta', 0.1)

me3.add_constant('model', 'jd')

[76]:

# for stoch volatility model

me4.add_constant('kappa', 2.0)

me4.add_constant('theta', 0.3)

me4.add_constant('vol_vol', 0.2)

me4.add_constant('rho', -0.75)

me4.add_constant('model', 'sv')

[77]:

val_env.add_constant('paths', 10000)

val_env.add_constant('frequency', 'W')

val_env.add_curve('time_grid', None)

In this case, we need to specify three correlation values.

[78]:

risk_factors = {'gbm1' : me1, 'gbm2' : me2, 'jd' : me3, 'sv' : me4}

correlations = [['gbm1', 'gbm2', 0.5], ['gbm2', 'jd', -0.5], ['gbm1', 'sv', 0.7]]

The payoff function in this case gets a bit more complex.

[79]:

# European maximum call payoff

payoff_1 = "np.maximum(np.maximum(np.maximum(maturity_value['gbm1'], maturity_value['gbm2']),"

payoff_2 = " np.maximum(maturity_value['jd'], maturity_value['sv'])) - 40, 0)"

payoff = payoff_1 + payoff_2

[80]:

payoff

[80]:

"np.maximum(np.maximum(np.maximum(maturity_value['gbm1'], maturity_value['gbm2']), np.maximum(maturity_value['jd'], maturity_value['sv'])) - 40, 0)"

However, the instantiation of the valuation classe remains the same.

[81]:

vc = valuation_mcs_european_multi(

name='European maximum call',

val_env=val_env,

risk_factors=risk_factors,

correlations=correlations,

payoff_func=payoff)

5.5.2. Example Output and Calculations¶

The following just displays some example output and the results from certain calculations.

[82]:

vc.risk_factors

[82]:

{'gbm1': <dx.frame.market_environment at 0x114a74978>,

'gbm2': <dx.frame.market_environment at 0x114a74940>,

'jd': <dx.frame.market_environment at 0x115ae88d0>,

'sv': <dx.frame.market_environment at 0x115ae81d0>}

[83]:

vc.underlying_objects

[83]:

{'gbm1': <dx.models.geometric_brownian_motion.geometric_brownian_motion at 0x115ae8a58>,

'gbm2': <dx.models.geometric_brownian_motion.geometric_brownian_motion at 0x116613710>,

'jd': <dx.models.jump_diffusion.jump_diffusion at 0x1166131d0>,

'sv': <dx.models.stochastic_volatility.stochastic_volatility at 0x1166139b0>}

[84]:

vc.present_value()

[84]:

13.197

The correlation and Cholesky matrices now are of shape 4x4.

[85]:

vc.correlation_matrix

[85]:

| gbm1 | gbm2 | jd | sv | |

|---|---|---|---|---|

| gbm1 | 1.0 | 0.5 | 0.0 | 0.7 |

| gbm2 | 0.5 | 1.0 | -0.5 | 0.0 |

| jd | 0.0 | -0.5 | 1.0 | 0.0 |

| sv | 0.7 | 0.0 | 0.0 | 1.0 |

[86]:

vc.val_env.get_list('cholesky_matrix')

[86]:

array([[ 1. , 0. , 0. , 0. ],

[ 0.5 , 0.8660254 , 0. , 0. ],

[ 0. , -0.57735027, 0.81649658, 0. ],

[ 0.7 , -0.40414519, -0.2857738 , 0.51478151]])

Delta and vega estimates are generated in exactly the same fashion as in the two risk factor case.

[87]:

vc.delta('jd', interval=0.1)

[87]:

0.4549

[88]:

vc.delta('sv')

[88]:

0.3782

[89]:

vc.vega('jd')

[89]:

5.8494

[90]:

vc.vega('sv')

[90]:

1.199

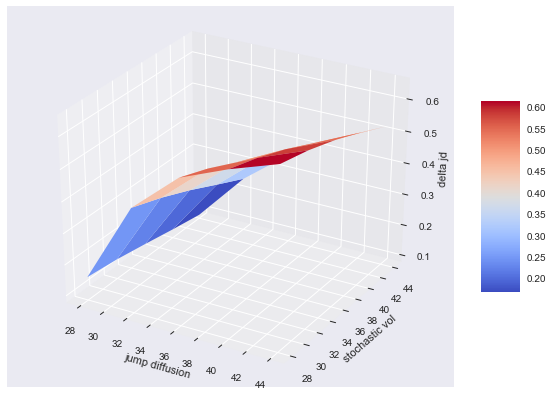

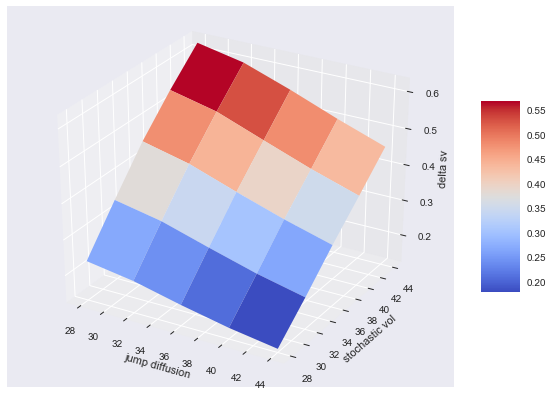

5.5.3. Delta for Jump Diffusion and Stochastic Vol Process¶

Of course, we cannot visualize Greek surfaces dependent on initial values for all four risk factors but still for two. In what follows we generate the delta surfaces with respect to the jump diffusion- and stochastic volatility-based risk factors.

[91]:

delta_1 = np.zeros_like(a_1)

delta_2 = np.zeros_like(a_1)

[92]:

%%time

for i in range(np.shape(delta_1)[0]):

for j in range(np.shape(delta_1)[1]):

vc.update('jd', initial_value=a_1[i, j])

vc.update('sv', initial_value=a_2[i, j])

delta_1[i, j] = vc.delta('jd')

delta_2[i, j] = vc.delta('sv')

CPU times: user 8.28 s, sys: 820 ms, total: 9.1 s

Wall time: 8.44 s

[93]:

plot_greeks_3d([a_1, a_2, delta_1], ['jump diffusion', 'stochastic vol', 'delta jd'])

[94]:

plot_greeks_3d([a_1, a_2, delta_2], ['jump diffusion', 'stochastic vol', 'delta sv'])

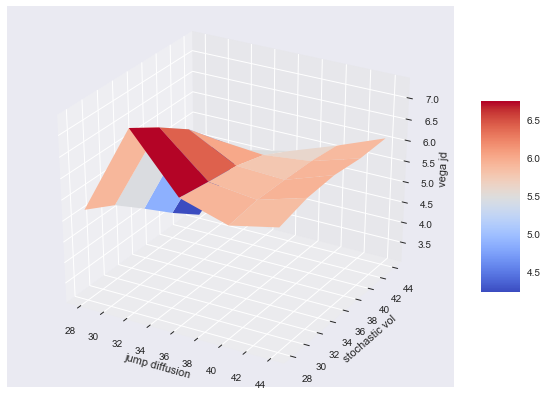

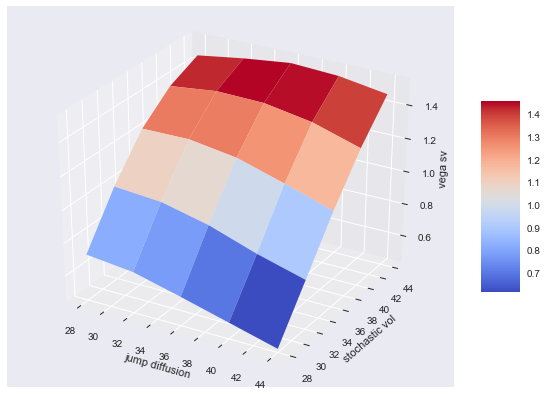

5.5.4. Vega for Jump Diffusion and Stochastic Vol Process¶

Now the same exercise for the vega surfaces for the same two risk factors.

[95]:

vega_1 = np.zeros_like(a_1)

vega_2 = np.zeros_like(a_1)

[96]:

%%time

for i in range(np.shape(vega_1)[0]):

for j in range(np.shape(vega_1)[1]):

vc.update('jd', initial_value=a_1[i, j])

vc.update('sv', initial_value=a_2[i, j])

vega_1[i, j] = vc.vega('jd')

vega_2[i, j] = vc.vega('sv')

CPU times: user 7.82 s, sys: 710 ms, total: 8.53 s

Wall time: 7.97 s

[97]:

plot_greeks_3d([a_1, a_2, vega_1], ['jump diffusion', 'stochastic vol', 'vega jd'])

[98]:

plot_greeks_3d([a_1, a_2, vega_2], ['jump diffusion', 'stochastic vol', 'vega sv'])

5.5.5. American Exercise¶

As a final illustration consider the case of an American minimum put option on the four risk factors. This again is a step that leads to a much increased computational burden due to the necessity to apply the least-squares regression approach.

[99]:

# payoff of American minimum put option

payoff_am_1 = "np.maximum(40 - np.minimum(np.minimum(instrument_values['gbm1'], instrument_values['gbm2']),"

payoff_am_2 = "np.minimum(instrument_values['jd'], instrument_values['sv'])), 0)"

payoff_am = payoff_am_1 + payoff_am_2

[100]:

vca = valuation_mcs_american_multi(

name='American minimum put',

val_env=val_env,

risk_factors=risk_factors,

correlations=correlations,

payoff_func=payoff_am)

However, another illustration that even such a complex instrument can be handled as elegantly as the most simple one (i.e. European option on single risk factor). Let us compare the present value estimates for both the European and American maximum basket options.

[101]:

# restore initial values

vc.update('jd', initial_value=36., volatility=0.1)

vc.update('sv', initial_value=36., volatility=0.1)

%time vc.present_value()

CPU times: user 3.78 ms, sys: 24 µs, total: 3.81 ms

Wall time: 3.84 ms

[101]:

13.197

[102]:

%time vca.present_value()

CPU times: user 335 ms, sys: 39.7 ms, total: 375 ms

Wall time: 321 ms

[102]:

14.301

[103]:

%time vca.delta('gbm1')

CPU times: user 439 ms, sys: 48.3 ms, total: 487 ms

Wall time: 401 ms

[103]:

-0.0034

[104]:

%time vca.delta('gbm2')

CPU times: user 491 ms, sys: 59.4 ms, total: 550 ms

Wall time: 452 ms

[104]:

-0.2115

[105]:

%time vca.vega('jd')

CPU times: user 514 ms, sys: 55.1 ms, total: 569 ms

Wall time: 475 ms

[105]:

1.994

[106]:

%time vca.vega('sv')

CPU times: user 546 ms, sys: 56.1 ms, total: 602 ms

Wall time: 509 ms

[106]:

0.5641

[107]:

print('Duration for notebook execution %.2f in min' % ((time.time() - t0) / 60))

Duration for notebook execution 1.19 in min

Copyright, License & Disclaimer

© Dr. Yves J. Hilpisch | The Python Quants GmbH

DX Analytics (the “dx library” or “dx package”) is licensed under the GNU Affero General Public License version 3 or later (see http://www.gnu.org/licenses/).

DX Analytics comes with no representations or warranties, to the extent permitted by applicable law.

http://tpq.io | dx@tpq.io | http://twitter.com/dyjh

Quant Platform | http://pqp.io

Python for Finance Training | http://training.tpq.io

Certificate in Computational Finance | http://compfinance.tpq.io

Derivatives Analytics with Python (Wiley Finance) | http://dawp.tpq.io

Python for Finance (2nd ed., O’Reilly) | http://py4fi.tpq.io