4. Single-Risk Derivatives Valuation¶

This part introduces into the modeling and valuation of derivatives instruments (contingent claims) based on a single risk factor (e.g. a stock price, stock index level or interest rate). It also shows how to model and value portfolios composed of such instruments.

[1]:

from dx import *

from pylab import plt

plt.style.use('seaborn')

The following single risk factor valuation classes are available:

valuation_mcs_european_singlefor derivatives with European exercisevaluation_mcs_american_singlefor derivatives with American/Bermudan exercise

4.1. Modeling the Risk Factor¶

Before moving on to the valuation classes, we need to model an instantiate an underlying risk factor, in this case a geometric_brownian_motion object. Background information is provided in the respective part of the documentation about model classes.

[2]:

r = constant_short_rate('r', 0.06)

[3]:

me = market_environment('me', dt.datetime(2015, 1, 1))

[4]:

me.add_constant('initial_value', 36.)

me.add_constant('volatility', 0.2)

me.add_constant('final_date', dt.datetime(2015, 12, 31))

me.add_constant('currency', 'EUR')

me.add_constant('frequency', 'W')

me.add_constant('paths', 25000)

[5]:

me.add_curve('discount_curve', r)

[6]:

gbm = geometric_brownian_motion('gbm', me)

4.2. valuation_mcs_european_single¶

The first instrument we value is a European call option written on the single relevant risk factor as embodied by the gbm model object. To this end, we add a maturity date to the market environment and a strike price.

[7]:

me.add_constant('maturity', dt.datetime(2015, 12, 31))

me.add_constant('strike', 40.)

To instantiate a the valuation_mcs_european_single class, the following information/data is to be provided:

- name as a

stringobject - instance of a model class

- market environment

- payoff of the instrument a

stringobject and containing “regular” Python/NumPy code

[8]:

call_eur = valuation_mcs_european_single(

name='call_eur',

underlying=gbm,

mar_env=me,

payoff_func='np.maximum(maturity_value - strike, 0)')

In this case, the payoff is that of a regular, plain vanilla European call option. If \(T\) is the maturity date, \(S_T\) the value of the relevant risk factor at that date and \(K\) the strike price, the payoff \(h_T\) at maturity of such an option is given by

maturity_value represents the value vector of the risk factor at maturity. Any other “sensible” payoff definition is possible. For instance, the following works as well:

[9]:

payoff = 'np.maximum(np.minimum(maturity_value) * 2 - 50, 0)'

Other standardized payoff elemenets include mean_value, max_value and min_value representing maturity value vectors with the pathwise means, maxima and minima. Using these payoff elements allows the easy definition of options with Asian features.

Having instantiated the valuation class, the present_value method returns the present value Monte Carlo estimator for the call option.

[10]:

call_eur.present_value()

[10]:

2.172619

Similarly, the delta and vega methods return the delta and the vega of the option, estimated numerically by a forward difference scheme and Monte Carlo simulation.

[11]:

call_eur.delta()

[11]:

0.4491

[12]:

call_eur.vega()

[12]:

14.1882

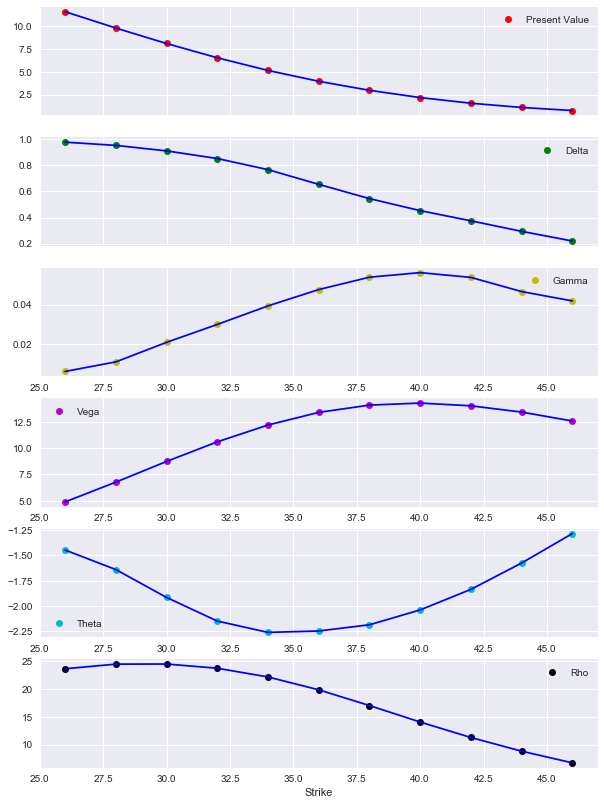

This approach allows to work with such a valuation object similar to an analytical valuation formula like the one of Black-Scholes-Merton (1973). For example, you can estimate and plot present values, deltas, gammas, vegas, thetas and rhos for a range of different initial values of the risk factor.

[13]:

%%time

k_list = np.arange(26., 46.1, 2)

pv = []; de = []; ve = []; th = []; rh = []; ga = []

for k in k_list:

call_eur.update(strike=k)

pv.append(call_eur.present_value())

de.append(call_eur.delta(0.5))

ve.append(call_eur.vega(0.2))

th.append(call_eur.theta())

rh.append(call_eur.rho())

ga.append(call_eur.gamma())

CPU times: user 6.64 s, sys: 954 ms, total: 7.59 s

Wall time: 7.66 s

[14]:

%matplotlib inline

There is a little plot helper function available to plot these statistics conveniently.

[15]:

plot_option_stats_full(k_list, pv, de, ga, ve, th, rh)

4.3. valuation_mcs_american_single¶

The modeling and valuation of derivatives with American/Bermudan exercise is almost completely the same as in the more simple case of European exercise.

[16]:

me.add_constant('initial_value', 36.)

# reset initial_value

[17]:

put_ame = valuation_mcs_american_single(

name='put_eur',

underlying=gbm,

mar_env=me,

payoff_func='np.maximum(strike - instrument_values, 0)')

The only difference to consider here is that for American options where exercise can take place at any time before maturity, the inner value of the option (payoff of immediate exercise) is relevant over the whole set of dates. Therefore, maturity_value needs to be replaced by instrument_values in the definition of the payoff function.

[18]:

put_ame.present_value()

[18]:

4.452

Since DX Analytics relies on Monte Carlo simulation and other numerical methods, the calculation of the delta and vega of such an option is identical to the European exercise case.

[19]:

put_ame.delta()

[19]:

-0.6655

[20]:

put_ame.vega()

[20]:

10.3122

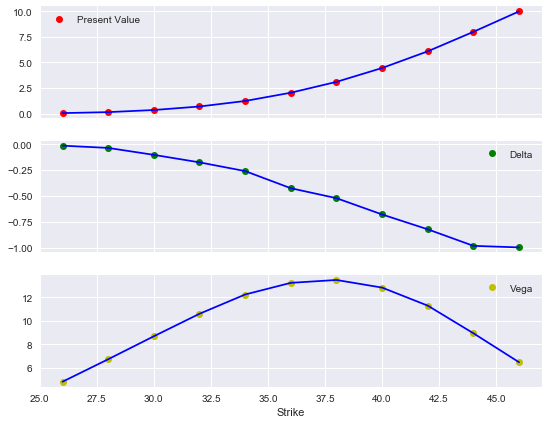

[21]:

%%time

k_list = np.arange(26., 46.1, 2.)

pv = []; de = []; ve = []

for k in k_list:

put_ame.update(strike=k)

pv.append(put_ame.present_value())

de.append(put_ame.delta(.5))

ve.append(put_ame.vega(0.2))

CPU times: user 15.5 s, sys: 957 ms, total: 16.5 s

Wall time: 16.1 s

[22]:

plot_option_stats(k_list, pv, de, ve)

4.4. Portfolio Valuation¶

In general, market players (asset managers, investment banks, hedge funds, insurance companies, etc.) have to value not only single derivatvies instruments but rather portfolios composed of several derivatives instruments. A consistent derivatives portfolio valuation is particularly important when there are multiple derivatives written on the same risk factor and/or correlations between different risk factors.

These are the classes availble for a consistent portfolio valuation:

derivatives_positionto model a portfolio positionderivatives_portfolioto model a derivatives portfolio

4.4.1. derivatives_position¶

We work with the market_environment object from before and add information about the risk factor model we are using.

[23]:

me.add_constant('model', 'gbm')

A derivatives position consists of “data only” and not instantiated model or valuation objects. The necessary model and valuation objects are instantiated during the portfolio valuation.

[24]:

put = derivatives_position(

name='put', # name of position

quantity=1, # number of instruments

underlyings=['gbm'], # relevant risk factors

mar_env=me, # market environment

otype='American single', # the option type

payoff_func='np.maximum(40. - instrument_values, 0)')

# the payoff funtion

The method get_info prints an overview of the all relevant information stored for the respective derivatives_position object.

[25]:

put.get_info()

NAME

put

QUANTITY

1

UNDERLYINGS

['gbm']

MARKET ENVIRONMENT

**Constants**

initial_value 36.0

volatility 0.2

final_date 2015-12-31 00:00:00

currency EUR

frequency W

paths 25000

maturity 2015-12-31 00:00:00

strike 40.0

model gbm

**Lists**

**Curves**

discount_curve <dx.frame.constant_short_rate object at 0x106799978>

OPTION TYPE

American single

PAYOFF FUNCTION

np.maximum(40. - instrument_values, 0)

4.4.2. derivatives_portfolio¶

The derivatives_portfolio class implements the core portfolio valuation tasks. This sub-section illustrates to cases, one with uncorrelated underlyings and another one with correlated underlyings