10. Implied Volatilities and Model Calibration¶

This setion of the documentation illustrates how to calculate implied volatilities and how to calibrate a model to VSTOXX volatility index call option quotes. The example implements the calibration for a total of one month worth of data.

[1]:

from dx import *

import numpy as np

import pandas as pd

from pylab import plt

plt.style.use('seaborn')

10.1. VSTOXX Futures & Options Data¶

We start by loading VSTOXX data from a pandas HDFStore into DataFrame objects (source: Eurex, cf. http://www.eurexchange.com/advanced-services/).

[2]:

h5 = pd.HDFStore('./data/vstoxx_march_2014.h5', 'r')

vstoxx_index = h5['vstoxx_index']

vstoxx_futures = h5['vstoxx_futures']

vstoxx_options = h5['vstoxx_options']

h5.close()

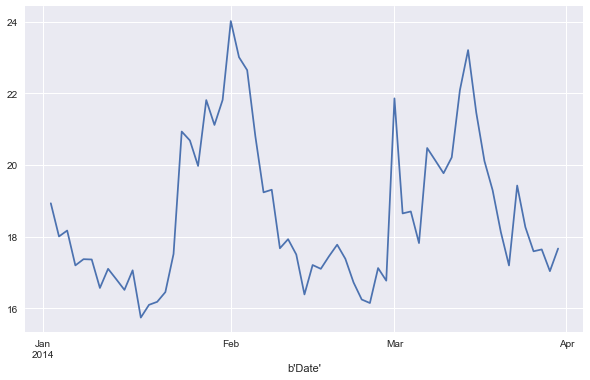

VSTOXX index for the first quarter of 2014.

[3]:

%matplotlib inline

vstoxx_index['V2TX'].plot(figsize=(10, 6))

[3]:

<matplotlib.axes._subplots.AxesSubplot at 0x115520978>

The VSTOXX futures data (8 futures maturities/quotes per day).

[4]:

vstoxx_futures.info()

<class 'pandas.core.frame.DataFrame'>

Int64Index: 504 entries, 0 to 503

Data columns (total 5 columns):

DATE 504 non-null datetime64[ns]

EXP_YEAR 504 non-null int64

EXP_MONTH 504 non-null int64

PRICE 504 non-null float64

MATURITY 504 non-null datetime64[ns]

dtypes: datetime64[ns](2), float64(1), int64(2)

memory usage: 23.6 KB

[5]:

vstoxx_futures.tail()

[5]:

| DATE | EXP_YEAR | EXP_MONTH | PRICE | MATURITY | |

|---|---|---|---|---|---|

| 499 | 2014-03-31 | 2014 | 7 | 20.40 | 2014-07-18 |

| 500 | 2014-03-31 | 2014 | 8 | 20.70 | 2014-08-15 |

| 501 | 2014-03-31 | 2014 | 9 | 20.95 | 2014-09-19 |

| 502 | 2014-03-31 | 2014 | 10 | 21.05 | 2014-10-17 |

| 503 | 2014-03-31 | 2014 | 11 | 21.25 | 2014-11-21 |

The VSTOXX options data. This data set is quite large due to the large number of European put and call options on the VSTOXX.

[6]:

vstoxx_options.info()

<class 'pandas.core.frame.DataFrame'>

Int64Index: 46960 entries, 0 to 46959

Data columns (total 7 columns):

DATE 46960 non-null datetime64[ns]

EXP_YEAR 46960 non-null int64

EXP_MONTH 46960 non-null int64

TYPE 46960 non-null object

STRIKE 46960 non-null float64

PRICE 46960 non-null float64

MATURITY 46960 non-null datetime64[ns]

dtypes: datetime64[ns](2), float64(2), int64(2), object(1)

memory usage: 2.9+ MB

[7]:

vstoxx_options.tail()

[7]:

| DATE | EXP_YEAR | EXP_MONTH | TYPE | STRIKE | PRICE | MATURITY | |

|---|---|---|---|---|---|---|---|

| 46955 | 2014-03-31 | 2014 | 11 | P | 85.0 | 63.65 | 2014-11-21 |

| 46956 | 2014-03-31 | 2014 | 11 | P | 90.0 | 68.65 | 2014-11-21 |

| 46957 | 2014-03-31 | 2014 | 11 | P | 95.0 | 73.65 | 2014-11-21 |

| 46958 | 2014-03-31 | 2014 | 11 | P | 100.0 | 78.65 | 2014-11-21 |

| 46959 | 2014-03-31 | 2014 | 11 | P | 105.0 | 83.65 | 2014-11-21 |

As a helper function we need a function to calculate all relevant third Fridays for all relevant maturity months of the data sets.

[8]:

import datetime as dt

import calendar

def third_friday(date):

day = 21 - (calendar.weekday(date.year, date.month, 1) + 2) % 7

return dt.datetime(date.year, date.month, day)

[9]:

third_fridays = {}

for month in set(vstoxx_futures['EXP_MONTH']):

third_fridays[month] = third_friday(dt.datetime(2014, month, 1))

[10]:

third_fridays

[10]:

{1: datetime.datetime(2014, 1, 17, 0, 0),

2: datetime.datetime(2014, 2, 21, 0, 0),

3: datetime.datetime(2014, 3, 21, 0, 0),

4: datetime.datetime(2014, 4, 18, 0, 0),

5: datetime.datetime(2014, 5, 16, 0, 0),

6: datetime.datetime(2014, 6, 20, 0, 0),

7: datetime.datetime(2014, 7, 18, 0, 0),

8: datetime.datetime(2014, 8, 15, 0, 0),

9: datetime.datetime(2014, 9, 19, 0, 0),

10: datetime.datetime(2014, 10, 17, 0, 0),

11: datetime.datetime(2014, 11, 21, 0, 0)}

10.2. Implied Volatilities from Market Quotes¶

Often calibration efforts are undertaken to replicate the market implied volatilities or the so-called volatility surface as good as possible. With DX Analytics and the BSM_european_option class, you can efficiently calculate (i.e. numerically estimate) implied volatilities. For the example, we use the VSTOXX futures and call options data from 31. March 2014.

Some definitions, the pre-selection of option data and the pre-definition of the market environment needed.

[11]:

V0 = 17.6639 # VSTOXX level on 31.03.2014

futures_data = vstoxx_futures[vstoxx_futures.DATE == '2014/3/31'].copy()

options_data = vstoxx_options[(vstoxx_options.DATE == '2014/3/31')

& (vstoxx_options.TYPE == 'C')].copy()

me = market_environment('me', dt.datetime(2014, 3, 31))

me.add_constant('initial_value', 17.6639) # index on 31.03.2014

me.add_constant('volatility', 2.0) # for initialization

me.add_curve('discount_curve', constant_short_rate('r', 0.01)) # assumption

options_data['IMP_VOL'] = 0.0 # initialization new iv column

The following loop now calculates the implied volatilities for all those options whose strike lies within the defined tolerance level.

[12]:

%%time

tol = 0.3 # tolerance level for moneyness

for option in options_data.index:

# iterating over all option quotes

forward = futures_data[futures_data['MATURITY'] == \

options_data.loc[option]['MATURITY']]['PRICE'].values

# picking the right futures value

if (forward * (1 - tol) < options_data.loc[option]['STRIKE']

< forward * (1 + tol)):

# only for options with moneyness within tolerance

call = options_data.loc[option]

me.add_constant('strike', call['STRIKE'])

me.add_constant('maturity', call['MATURITY'])

call_option = BSM_european_option('call', me)

options_data.loc[option, 'IMP_VOL'] = \

call_option.imp_vol(call['PRICE'], 'call', volatility_est=0.6)

CPU times: user 691 ms, sys: 6.05 ms, total: 698 ms

Wall time: 695 ms

A selection of the results.

[13]:

options_data[60:70]

[13]:

| DATE | EXP_YEAR | EXP_MONTH | TYPE | STRIKE | PRICE | MATURITY | IMP_VOL | |

|---|---|---|---|---|---|---|---|---|

| 46230 | 2014-03-31 | 2014 | 5 | C | 12.0 | 7.55 | 2014-05-16 | 0.000000 |

| 46231 | 2014-03-31 | 2014 | 5 | C | 13.0 | 6.55 | 2014-05-16 | 0.000000 |

| 46232 | 2014-03-31 | 2014 | 5 | C | 14.0 | 5.55 | 2014-05-16 | 1.541568 |

| 46233 | 2014-03-31 | 2014 | 5 | C | 15.0 | 4.55 | 2014-05-16 | 1.321803 |

| 46234 | 2014-03-31 | 2014 | 5 | C | 16.0 | 3.65 | 2014-05-16 | 1.153001 |

| 46235 | 2014-03-31 | 2014 | 5 | C | 17.0 | 2.90 | 2014-05-16 | 1.042549 |

| 46236 | 2014-03-31 | 2014 | 5 | C | 18.0 | 2.35 | 2014-05-16 | 0.997178 |

| 46237 | 2014-03-31 | 2014 | 5 | C | 19.0 | 1.90 | 2014-05-16 | 0.969301 |

| 46238 | 2014-03-31 | 2014 | 5 | C | 20.0 | 1.55 | 2014-05-16 | 0.958777 |

| 46239 | 2014-03-31 | 2014 | 5 | C | 21.0 | 1.30 | 2014-05-16 | 0.968430 |

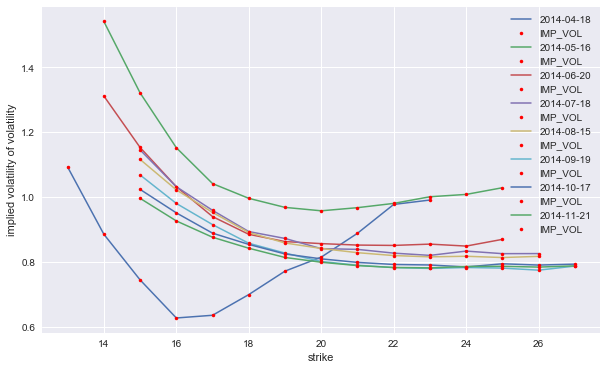

And the complete results visualized.

[14]:

import matplotlib.pyplot as plt

%matplotlib inline

plot_data = options_data[options_data.IMP_VOL > 0]

plt.figure(figsize=(10, 6))

for maturity in sorted(set(options_data['MATURITY'])):

data = plot_data.isin({'MATURITY': [maturity,]})

data = plot_data[plot_data.MATURITY == maturity]

# select data for this maturity

plt.plot(data['STRIKE'], data['IMP_VOL'],

label=maturity.date(), lw=1.5)

plt.plot(data['STRIKE'], data['IMP_VOL'], 'r.')

plt.xlabel('strike')

plt.ylabel('implied volatility of volatility')

plt.legend()

plt.show()

10.3. Market Modeling¶

This sub-section now implements the model calibration based on selected options data. In particular, we choose, for a given pricing date, the following options data:

- for a single maturity only

- call options only

- for a certain moneyness of the options

10.3.1. Relevant Market Data¶

The following following returns the relevant market data per calibration date:

[15]:

tol = 0.2

def get_option_selection(pricing_date, maturity, tol=tol):

''' Function selects relevant options data. '''

forward = vstoxx_futures[(vstoxx_futures.DATE == pricing_date)

& (vstoxx_futures.MATURITY == maturity)]['PRICE'].values[0]

option_selection = \

vstoxx_options[(vstoxx_options.DATE == pricing_date)

& (vstoxx_options.MATURITY == maturity)

& (vstoxx_options.TYPE == 'C')

& (vstoxx_options.STRIKE > (1 - tol) * forward)

& (vstoxx_options.STRIKE < (1 + tol) * forward)]

return option_selection, forward

10.3.2. Options Modeling¶

Given the options and their respective quotes to which to calibrate the model, the function get_option_models returns the DX Analytics option models for all relevant options. As risk factor model we use the square_root_diffusion class.

[16]:

def get_option_models(pricing_date, maturity, option_selection):

''' Models and returns traded options for given option_selection object. '''

me_vstoxx = market_environment('me_vstoxx', pricing_date)

initial_value = vstoxx_index['V2TX'][pricing_date]

me_vstoxx.add_constant('initial_value', initial_value)

me_vstoxx.add_constant('final_date', maturity)

me_vstoxx.add_constant('currency', 'EUR')

me_vstoxx.add_constant('frequency', 'W')

me_vstoxx.add_constant('paths', 10000)

csr = constant_short_rate('csr', 0.01)

# somewhat arbitrarily chosen here

me_vstoxx.add_curve('discount_curve', csr)

# parameters to be calibrated later

me_vstoxx.add_constant('kappa', 1.0)

me_vstoxx.add_constant('theta', 1.2 * initial_value)

me_vstoxx.add_constant('volatility', 1.0)

vstoxx_model = square_root_diffusion('vstoxx_model', me_vstoxx)

# square-root diffusion for volatility modeling

# mean-reverting, positive process

# option parameters and payoff

me_vstoxx.add_constant('maturity', maturity)

payoff_func = 'np.maximum(maturity_value - strike, 0)'

option_models = {}

for option in option_selection.index:

strike = option_selection['STRIKE'].ix[option]

me_vstoxx.add_constant('strike', strike)

option_models[option] = \

valuation_mcs_european_single(

'eur_call_%d' % strike,

vstoxx_model,

me_vstoxx,

payoff_func)

return vstoxx_model, option_models

The function calculate_model_values estimates and returns model value estimates for all relevant options given a parameter set for the square_root_diffusion risk factor model.

[17]:

def calculate_model_values(p0):

''' Returns all relevant option values.

Parameters

===========

p0 : tuple/list

tuple of kappa, theta, volatility

Returns

=======

model_values : dict

dictionary with model values

'''

kappa, theta, volatility = p0

vstoxx_model.update(kappa=kappa,

theta=theta,

volatility=volatility)

model_values = {}

for option in option_models:

model_values[option] = \

option_models[option].present_value(fixed_seed=True)

return model_values

10.4. Calibration Functions¶

10.4.1. Mean-Squared Error Calculation¶

The calibration of the pricing model is based on the minimization of the mean-squared error (MSE) of the model values vs. the market quotes. The MSE calculation is implemented by the function mean_squared_error which also penalizes economically implausible parameter values.

[18]:

i = 0

def mean_squared_error(p0):

''' Returns the mean-squared error given

the model and market values.

Parameters

===========

p0 : tuple/list

tuple of kappa, theta, volatility

Returns

=======

MSE : float

mean-squared error

'''

if p0[0] < 0 or p0[1] < 5. or p0[2] < 0 or p0[2] > 10.:

return 100

global i, option_selection, vstoxx_model, option_models, first, last

pd = dt.datetime.strftime(

option_selection['DATE'].iloc[0].to_pydatetime(),

'%d-%b-%Y')

mat = dt.datetime.strftime(

option_selection['MATURITY'].iloc[0].to_pydatetime(),

'%d-%b-%Y')

model_values = calculate_model_values(p0)

option_diffs = {}

for option in model_values:

option_diffs[option] = (model_values[option]

- option_selection['PRICE'].loc[option])

MSE = np.sum(np.array(list(option_diffs.values())) ** 2) / len(option_diffs)

if i % 150 == 0:

# output every 0th and 100th iteration

if i == 0:

print('%12s %13s %4s %6s %6s %6s --> %6s' % \

('pricing_date', 'maturity_date', 'i', 'kappa',

'theta', 'vola', 'MSE'))

print('%12s %13s %4d %6.3f %6.3f %6.3f --> %6.3f' % \

(pd, mat, i, p0[0], p0[1], p0[2], MSE))

i += 1

return MSE

10.4.2. Implementing the Calibration Procedure¶

The function get_parameter_series calibrates the model to the market data for every date contained in the pricing_date_list object for all maturities contained in the maturity_list object.

[19]:

import scipy.optimize as spo

def get_parameter_series(pricing_date_list, maturity_list):

global i, option_selection, vstoxx_model, option_models, first, last

# collects optimization results for later use (eg. visualization)

parameters = pd.DataFrame()

for maturity in maturity_list:

first = True

for pricing_date in pricing_date_list:

option_selection, forward = \

get_option_selection(pricing_date, maturity)

vstoxx_model, option_models = \

get_option_models(pricing_date, maturity, option_selection)

if first is True:

# use brute force for the first run

i = 0

opt = spo.brute(mean_squared_error,

((0.5, 2.51, 1.), # range for kappa

(10., 20.1, 5.), # range for theta

(0.5, 10.51, 5.0)), # range for volatility

finish=None)

i = 0

opt = spo.fmin(mean_squared_error, opt,

maxiter=200, maxfun=350, xtol=0.0000001, ftol=0.0000001)

parameters = parameters.append(

pd.DataFrame(

{'pricing_date' : pricing_date,

'maturity' : maturity,

'initial_value' : vstoxx_model.initial_value,

'kappa' : opt[0],

'theta' : opt[1],

'sigma' : opt[2],

'MSE' : mean_squared_error(opt)}, index=[0,]),

ignore_index=True)

first = False

last = opt

return parameters

10.4.3. The Calibration Itself¶

This completes the set of necessary function to implement such a larger calibration effort. The following code defines the dates for which a calibration shall be conducted and for which maturities the calibration is required.

[20]:

%%time

pricing_date_list = pd.date_range('2014/3/1', '2014/3/31', freq='B')

maturity_list = [third_fridays[7]]

parameters = get_parameter_series(pricing_date_list, maturity_list)

pricing_date maturity_date i kappa theta vola --> MSE

03-Mar-2014 18-Jul-2014 0 0.500 10.000 0.500 --> 4.507

pricing_date maturity_date i kappa theta vola --> MSE

03-Mar-2014 18-Jul-2014 0 2.500 15.000 5.500 --> 0.022

03-Mar-2014 18-Jul-2014 150 2.490 17.012 4.665 --> 0.005

Optimization terminated successfully.

Current function value: 0.004840

Iterations: 146

Function evaluations: 296

pricing_date maturity_date i kappa theta vola --> MSE

04-Mar-2014 18-Jul-2014 0 2.497 17.010 4.674 --> 0.048

04-Mar-2014 18-Jul-2014 150 2.474 17.633 4.738 --> 0.003

Optimization terminated successfully.

Current function value: 0.002750

Iterations: 70

Function evaluations: 164

pricing_date maturity_date i kappa theta vola --> MSE

05-Mar-2014 18-Jul-2014 0 2.474 17.633 4.738 --> 0.008

05-Mar-2014 18-Jul-2014 150 3.042 17.856 4.919 --> 0.003

05-Mar-2014 18-Jul-2014 300 4.407 17.995 5.667 --> 0.003

Warning: Maximum number of function evaluations has been exceeded.

pricing_date maturity_date i kappa theta vola --> MSE

06-Mar-2014 18-Jul-2014 0 4.407 17.995 5.668 --> 0.004

06-Mar-2014 18-Jul-2014 150 4.543 18.209 5.661 --> 0.003

Optimization terminated successfully.

Current function value: 0.003179

Iterations: 76

Function evaluations: 175

pricing_date maturity_date i kappa theta vola --> MSE

07-Mar-2014 18-Jul-2014 0 4.543 18.209 5.661 --> 0.030

07-Mar-2014 18-Jul-2014 150 4.958 18.332 5.553 --> 0.005

Optimization terminated successfully.

Current function value: 0.004775

Iterations: 84

Function evaluations: 183

pricing_date maturity_date i kappa theta vola --> MSE

10-Mar-2014 18-Jul-2014 0 4.958 18.332 5.553 --> 0.086

10-Mar-2014 18-Jul-2014 150 4.816 18.733 5.722 --> 0.003

Optimization terminated successfully.

Current function value: 0.002975

Iterations: 75

Function evaluations: 173

pricing_date maturity_date i kappa theta vola --> MSE

11-Mar-2014 18-Jul-2014 0 4.816 18.733 5.722 --> 0.006

11-Mar-2014 18-Jul-2014 150 4.281 19.060 5.162 --> 0.004

Optimization terminated successfully.

Current function value: 0.004069

Iterations: 100

Function evaluations: 210

pricing_date maturity_date i kappa theta vola --> MSE

12-Mar-2014 18-Jul-2014 0 4.281 19.060 5.162 --> 0.008

12-Mar-2014 18-Jul-2014 150 4.461 18.959 5.231 --> 0.005

Optimization terminated successfully.

Current function value: 0.004915

Iterations: 67

Function evaluations: 164

pricing_date maturity_date i kappa theta vola --> MSE

13-Mar-2014 18-Jul-2014 0 4.461 18.959 5.231 --> 0.007

13-Mar-2014 18-Jul-2014 150 4.515 18.920 5.333 --> 0.006

Optimization terminated successfully.

Current function value: 0.005971

Iterations: 84

Function evaluations: 189

pricing_date maturity_date i kappa theta vola --> MSE

14-Mar-2014 18-Jul-2014 0 4.515 18.920 5.333 --> 0.017

14-Mar-2014 18-Jul-2014 150 5.124 18.963 5.952 --> 0.003

Optimization terminated successfully.

Current function value: 0.002936

Iterations: 131

Function evaluations: 280

pricing_date maturity_date i kappa theta vola --> MSE

17-Mar-2014 18-Jul-2014 0 5.223 19.002 5.997 --> 0.025

17-Mar-2014 18-Jul-2014 150 5.330 18.581 6.097 --> 0.004

Optimization terminated successfully.

Current function value: 0.003809

Iterations: 81

Function evaluations: 185

pricing_date maturity_date i kappa theta vola --> MSE

18-Mar-2014 18-Jul-2014 0 5.330 18.581 6.097 --> 0.006

18-Mar-2014 18-Jul-2014 150 3.838 18.503 5.161 --> 0.003

Optimization terminated successfully.

Current function value: 0.002652

Iterations: 144

Function evaluations: 300

18-Mar-2014 18-Jul-2014 300 3.191 18.288 4.852 --> 0.003

pricing_date maturity_date i kappa theta vola --> MSE

19-Mar-2014 18-Jul-2014 0 3.191 18.288 4.852 --> 0.005

19-Mar-2014 18-Jul-2014 150 3.136 18.084 4.968 --> 0.003

Optimization terminated successfully.

Current function value: 0.003397

Iterations: 67

Function evaluations: 169

pricing_date maturity_date i kappa theta vola --> MSE

20-Mar-2014 18-Jul-2014 0 3.136 18.084 4.968 --> 0.010

20-Mar-2014 18-Jul-2014 150 2.936 18.441 4.849 --> 0.002

Optimization terminated successfully.

Current function value: 0.002263

Iterations: 128

Function evaluations: 267

pricing_date maturity_date i kappa theta vola --> MSE

21-Mar-2014 18-Jul-2014 0 2.928 18.450 4.842 --> 0.044

21-Mar-2014 18-Jul-2014 150 2.935 19.134 4.876 --> 0.004

Optimization terminated successfully.

Current function value: 0.003655

Iterations: 64

Function evaluations: 158

pricing_date maturity_date i kappa theta vola --> MSE

24-Mar-2014 18-Jul-2014 0 2.935 19.134 4.876 --> 0.021

24-Mar-2014 18-Jul-2014 150 5.169 18.555 6.217 --> 0.004

Optimization terminated successfully.

Current function value: 0.004381

Iterations: 138

Function evaluations: 297

pricing_date maturity_date i kappa theta vola --> MSE

25-Mar-2014 18-Jul-2014 0 5.653 18.592 6.449 --> 0.014

25-Mar-2014 18-Jul-2014 150 6.252 18.525 6.554 --> 0.003

Optimization terminated successfully.

Current function value: 0.002918

Iterations: 107

Function evaluations: 231

pricing_date maturity_date i kappa theta vola --> MSE

26-Mar-2014 18-Jul-2014 0 6.251 18.525 6.553 --> 0.014

26-Mar-2014 18-Jul-2014 150 5.189 18.301 6.063 --> 0.003

Optimization terminated successfully.

Current function value: 0.002839

Iterations: 107

Function evaluations: 243

pricing_date maturity_date i kappa theta vola --> MSE

27-Mar-2014 18-Jul-2014 0 5.189 18.301 6.063 --> 0.006

27-Mar-2014 18-Jul-2014 150 5.789 18.693 6.112 --> 0.003

Optimization terminated successfully.

Current function value: 0.002992

Iterations: 112

Function evaluations: 248

pricing_date maturity_date i kappa theta vola --> MSE

28-Mar-2014 18-Jul-2014 0 5.788 18.693 6.111 --> 0.003

28-Mar-2014 18-Jul-2014 150 5.684 18.828 5.974 --> 0.003

Optimization terminated successfully.

Current function value: 0.002811

Iterations: 97

Function evaluations: 216

pricing_date maturity_date i kappa theta vola --> MSE

31-Mar-2014 18-Jul-2014 0 5.683 18.828 5.974 --> 0.009

31-Mar-2014 18-Jul-2014 150 12.121 18.656 8.053 --> 0.004

31-Mar-2014 18-Jul-2014 300 15.247 18.578 8.978 --> 0.004

Warning: Maximum number of function evaluations has been exceeded.

CPU times: user 1min 6s, sys: 278 ms, total: 1min 6s

Wall time: 1min 6s

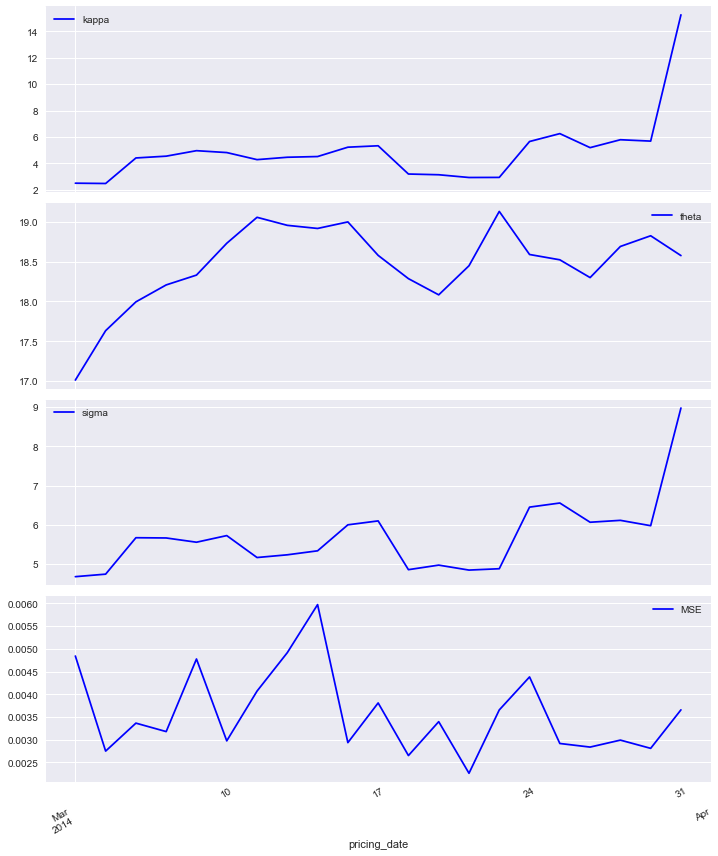

10.5. Calibration Results¶

The results are now stored in the pandas DataFrame called parameters. We set a new index and inspect the last results. Throughout the MSE is pretty low indicated a good fit of the model to the market quotes.

[21]:

paramet = parameters.set_index('pricing_date')

paramet.tail()

[21]:

| MSE | initial_value | kappa | maturity | sigma | theta | |

|---|---|---|---|---|---|---|

| pricing_date | ||||||

| 2014-03-25 | 0.002918 | 18.2637 | 6.250875 | 2014-07-18 | 6.553352 | 18.525022 |

| 2014-03-26 | 0.002839 | 17.5869 | 5.189260 | 2014-07-18 | 6.062754 | 18.301087 |

| 2014-03-27 | 0.002992 | 17.6397 | 5.787693 | 2014-07-18 | 6.111093 | 18.693053 |

| 2014-03-28 | 0.002811 | 17.0324 | 5.683422 | 2014-07-18 | 5.974289 | 18.827773 |

| 2014-03-31 | 0.003657 | 17.6639 | 15.246458 | 2014-07-18 | 8.978325 | 18.578233 |

This is also illustrated by the visualization of the time series data for the calibrated/optimal parameter values. The MSE is below 0.01 throughout.

[22]:

%matplotlib inline

paramet[['kappa', 'theta', 'sigma', 'MSE']].plot(subplots=True, color='b', figsize=(10, 12))

plt.tight_layout()

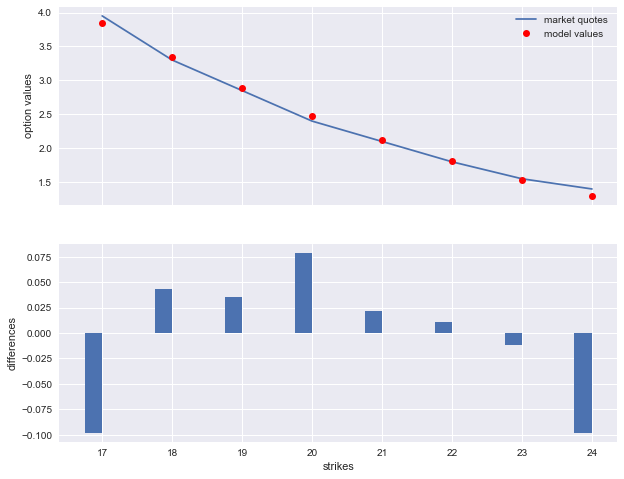

The following generates a plot of the calibration results for the last calibration day. The absolute price differences are below 0.10 EUR for all options.

[23]:

index = paramet.index[-1]

opt = np.array(paramet[['kappa', 'theta', 'sigma']].loc[index])

option_selection = get_option_selection(index, maturity_list[0], tol=tol)[0]

model_values = np.sort(np.array(list(calculate_model_values(opt).values())))[::-1]

import matplotlib.pyplot as plt

%matplotlib inline

fix, (ax1, ax2) = plt.subplots(2, sharex=True, figsize=(10, 8))

strikes = option_selection['STRIKE'].values

ax1.plot(strikes, option_selection['PRICE'], label='market quotes')

ax1.plot(strikes, model_values, 'ro', label='model values')

ax1.set_ylabel('option values')

ax1.grid(True)

ax1.legend(loc=0)

wi = 0.25

ax2.bar(strikes - wi / 2., model_values - option_selection['PRICE'],

label='market quotes', width=wi)

ax2.grid(True)

ax2.set_ylabel('differences')

ax2.set_xlabel('strikes')

[23]:

<matplotlib.text.Text at 0x116ec0b00>

Copyright, License & Disclaimer

© Dr. Yves J. Hilpisch | The Python Quants GmbH

DX Analytics (the “dx library” or “dx package”) is licensed under the GNU Affero General Public License version 3 or later (see http://www.gnu.org/licenses/).

DX Analytics comes with no representations or warranties, to the extent permitted by applicable law.

http://tpq.io | dx@tpq.io | http://twitter.com/dyjh

Quant Platform | http://pqp.io

Python for Finance Training | http://training.tpq.io

Certificate in Computational Finance | http://compfinance.tpq.io

Derivatives Analytics with Python (Wiley Finance) | http://dawp.tpq.io

Python for Finance (2nd ed., O’Reilly) | http://py4fi.tpq.io