7. Parallel Valuation of Large Portfolios¶

Derivatives (portfolio) valuation by Monte Carlo simulation is a computationally demanding task. For practical applications, when valuation speed plays an important role, parallelization of both simulation and valuation tasks might prove a useful strategy. DX Analytics has built in a basic parallelization option which allows the use of the Python mulitprocessing module. Depending on the tasks at hand this can already lead to significant speed-ups.

[1]:

from dx import *

import time

from pylab import plt

plt.style.use('seaborn')

%matplotlib inline

7.1. Single Risk Factor¶

The example is based on a single risk factor, a geometric_brownian_motion object.

[2]:

# constant short rate

r = constant_short_rate('r', 0.02)

[3]:

# market environments

me_gbm = market_environment('gbm', dt.datetime(2015, 1, 1))

[4]:

# geometric Brownian motion

me_gbm.add_constant('initial_value', 100.)

me_gbm.add_constant('volatility', 0.2)

me_gbm.add_constant('currency', 'EUR')

me_gbm.add_constant('model', 'gbm')

[5]:

# valuation environment

val_env = market_environment('val_env', dt.datetime(2015, 1, 1))

val_env.add_constant('paths', 25000)

val_env.add_constant('frequency', 'M')

val_env.add_curve('discount_curve', r)

val_env.add_constant('starting_date', dt.datetime(2015, 1, 1))

val_env.add_constant('final_date', dt.datetime(2015, 12, 31))

[6]:

# add valuation environment to market environments

me_gbm.add_environment(val_env)

[7]:

risk_factors = {'gbm' : me_gbm}

7.2. American Put Option¶

We also model only a single derivative instrument.

[8]:

gbm = geometric_brownian_motion('gbm_obj', me_gbm)

[9]:

me_put = market_environment('put', dt.datetime(2015, 1, 1))

me_put.add_constant('maturity', dt.datetime(2015, 12, 31))

me_put.add_constant('strike', 40.)

me_put.add_constant('currency', 'EUR')

me_put.add_environment(val_env)

[10]:

am_put = valuation_mcs_american_single(

'am_put', mar_env=me_put, underlying=gbm,

payoff_func='np.maximum(strike - instrument_values, 0)')

7.3. Large Portfolio¶

However, the derivatives_portfolio object we compose consists of 100 derivatives positions. Each option differes with respect to the strike.

[11]:

positions = {}

strikes = np.linspace(80, 120, 100)

for i, strike in enumerate(strikes):

positions[i] = derivatives_position(

name='am_put_pos_%s' % strike,

quantity=1,

underlyings=['gbm'],

mar_env=me_put,

otype='American single',

payoff_func='np.maximum(%5.3f - instrument_values, 0)' % strike)

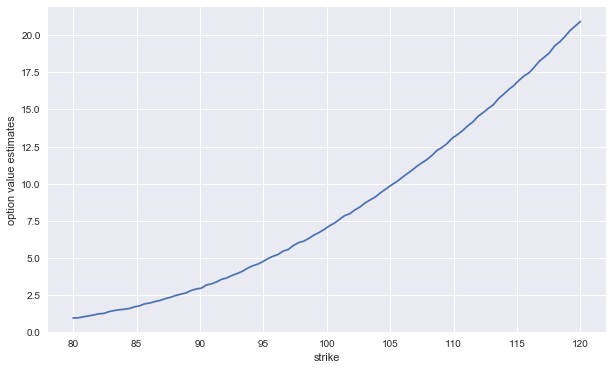

7.3.1. Sequential Valuation¶

First, the derivatives portfolio with sequential valuation.

[12]:

port_sequ = derivatives_portfolio(

name='portfolio',

positions=positions,

val_env=val_env,

risk_factors=risk_factors,

correlations=None,

parallel=False) # sequential calculation

The call of the get_values method to value all instruments …

[13]:

t0 = time.time()

ress = port_sequ.get_values()

ts = time.time() - t0

print('Time in sec %.2f' % ts)

Total

pos_value 839.234

dtype: float64

Time in sec 4.09

… and the results visualized.

[14]:

ress['strike'] = strikes

ress.set_index('strike')['value'].plot(figsize=(10, 6))

plt.ylabel('option value estimates')

[14]:

Text(0,0.5,'option value estimates')

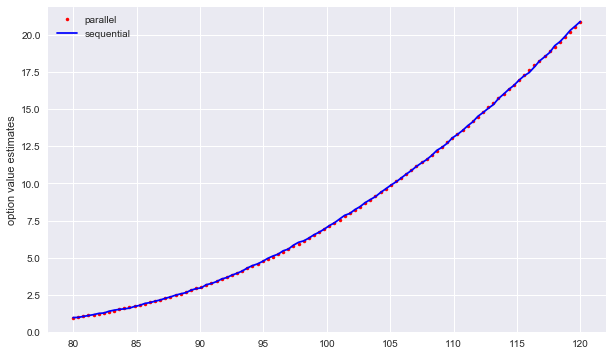

7.3.2. Parallel Valuation¶

Second, the derivatives portfolio with parallel valuation.

[15]:

port_para = derivatives_portfolio(

'portfolio',

positions,

val_env,

risk_factors,

correlations=None,

parallel=True) # parallel valuation

The call of the get_values method for the parall valuation case.

[16]:

t0 = time.time()

resp = port_para.get_values()

# parallel valuation with as many cores as available

tp = time.time() - t0

print('Time in sec %.2f' % tp)

Total

pos_value 840.238

dtype: float64

Time in sec 5.36

Again, the results visualized (and compared to the sequential results).

[17]:

plt.figure(figsize=(10, 6))

plt.plot(strikes, resp['value'].values, 'r.', label='parallel')

plt.plot(strikes, ress['value'].values, 'b', label='sequential')

plt.legend(loc=0)

plt.ylabel('option value estimates')

[17]:

Text(0,0.5,'option value estimates')

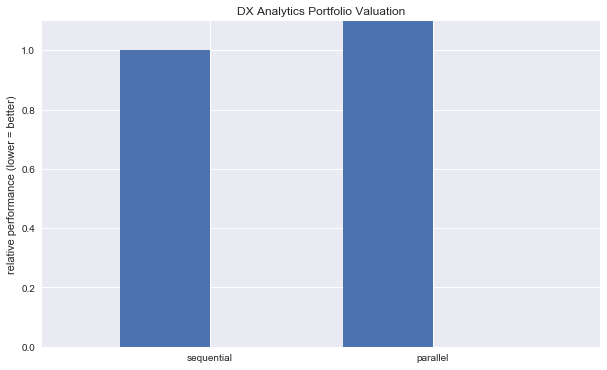

7.3.3. Speed-up¶

The realized speed-up is of course dependend on the hardware used, and in particular the number of cores (threads) available.

[18]:

ts / tp

# speed-up factor

# of course harware-dependent

[18]:

0.7630898756144515

[19]:

wi = 0.4

plt.figure(figsize=(10, 6))

plt.bar((1.5 - wi/2, 2.5 - wi/2), (ts/ts, tp/ts), width=wi)

plt.xticks((1.5, 2.5), ('sequential', 'parallel'))

plt.ylim(0, 1.1), plt.xlim(0.75, 3.25)

plt.ylabel('relative performance (lower = better)')

plt.title('DX Analytics Portfolio Valuation')

[19]:

Text(0.5,1,'DX Analytics Portfolio Valuation')

Copyright, License & Disclaimer

© Dr. Yves J. Hilpisch | The Python Quants GmbH

DX Analytics (the “dx library” or “dx package”) is licensed under the GNU Affero General Public License version 3 or later (see http://www.gnu.org/licenses/).

DX Analytics comes with no representations or warranties, to the extent permitted by applicable law.

http://tpq.io | dx@tpq.io | http://twitter.com/dyjh

Quant Platform | http://pqp.io

Python for Finance Training | http://training.tpq.io

Certificate in Computational Finance | http://compfinance.tpq.io

Derivatives Analytics with Python (Wiley Finance) | http://dawp.tpq.io

Python for Finance (2nd ed., O’Reilly) | http://py4fi.tpq.io