11. Interest Rate Swaps¶

Very nascent.

Interest rate swaps are a first step towards including rate-sensitive instruments in the modeling and valuation spectrum of DX Analytics. The model used in the following is the square-root diffusion process by Cox-Ingersoll-Ross (1985). Data used are UK/London OIS and Libor rates.

[1]:

import dx

import time

import numpy as np

import pandas as pd

import datetime as dt

from pylab import plt

plt.style.use('seaborn')

%matplotlib inline

11.1. OIS Data & Discounting¶

We start by importing OIS term structure data (source: http://www.bankofengland.co.uk) for risk-free discounting. We also adjust the data structure somewhat for our purposes.

[2]:

# UK OIS Spot Rates Yield Curve

oiss = pd.read_excel('data/ukois09.xls', 'oiss')

# use years as index

oiss = oiss.set_index('years')

# del oiss['years']

[3]:

# only date information for columns, no time

oiss.columns = [d.date() for d in oiss.columns]

[4]:

oiss.tail()

[4]:

| 2014-10-01 | 2014-10-02 | 2014-10-03 | 2014-10-06 | 2014-10-07 | 2014-10-08 | 2014-10-09 | 2014-10-10 | 2014-10-13 | 2014-10-14 | 2014-10-15 | 2014-10-16 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| years | ||||||||||||

| 4.666667 | 1.550947 | 1.525838 | 1.570203 | 1.533901 | 1.479044 | 1.445234 | 1.436023 | 1.409962 | 1.337567 | 1.283932 | 1.063205 | 1.234125 |

| 4.750000 | 1.563661 | 1.538616 | 1.583198 | 1.546459 | 1.491152 | 1.457593 | 1.448627 | 1.422015 | 1.349782 | 1.296052 | 1.074773 | 1.246277 |

| 4.833333 | 1.576142 | 1.551158 | 1.595952 | 1.558789 | 1.503050 | 1.469768 | 1.461040 | 1.433887 | 1.361832 | 1.308025 | 1.086254 | 1.258307 |

| 4.916667 | 1.588400 | 1.563474 | 1.608472 | 1.570898 | 1.514746 | 1.481764 | 1.473269 | 1.445585 | 1.373724 | 1.319859 | 1.097650 | 1.270219 |

| 5.000000 | 1.600442 | 1.575572 | 1.620768 | 1.582794 | 1.526247 | 1.493588 | 1.485320 | 1.457116 | 1.385461 | 1.331557 | 1.108962 | 1.282014 |

Next we replace the year fraction index by a DatetimeIndex.

[5]:

# generate time index given input data

# starting date + 59 months

date = oiss.columns[-1]

index = pd.date_range(date, periods=60, freq='M') # , tz='GMT')

index = [d.replace(day=date.day) for d in index]

index = pd.DatetimeIndex(index)

oiss.index = index

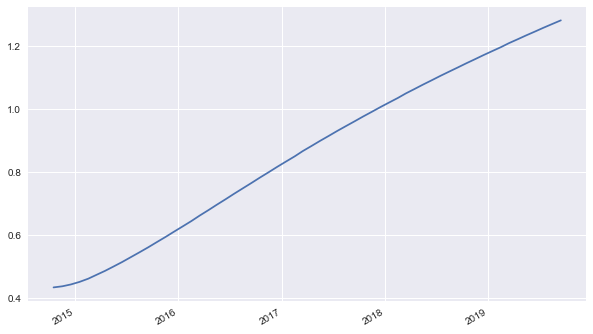

Let us have a look at the most current data, i.e. the term structure, of the data set.

[6]:

oiss.iloc[:, -1].plot(figsize=(10, 6))

[6]:

<matplotlib.axes._subplots.AxesSubplot at 0x10ba062b0>

This data is used to instantiate a deterministic_short_rate model for risk-neutral discounting purposes.

[7]:

# generate deterministic short rate model based on UK OIS curve

ois = dx.deterministic_short_rate('ois', list(zip(oiss.index, oiss.iloc[:, -1].values / 100)))

[8]:

# example dates and corresponding discount factors

dr = pd.date_range('2015-1', periods=4, freq='6m').to_pydatetime()

ois.get_discount_factors(dr)[::-1]

[8]:

([0.989825148692371, 0.9922754901627036, 0.9956237774158325, 1.0],

array([datetime.datetime(2015, 1, 31, 0, 0),

datetime.datetime(2015, 7, 31, 0, 0),

datetime.datetime(2016, 1, 31, 0, 0),

datetime.datetime(2016, 7, 31, 0, 0)], dtype=object))

11.2. Libor Market Data¶

We want to model a 3 month Libor-based interest rate swap. To this end, we need Libor term structure data, i.e. forward rates in this case (source: http://www.bankofengland.co.uk), to calibrate the valuation to. The data importing and adjustments are the same as before.

[9]:

# UK Libor foward rates

libf = pd.read_excel('data/ukblc05.xls', 'fwds')

# use years as index

libf = libf.set_index('years')

[10]:

# only date information for columns, no time

libf.columns = [d.date() for d in libf.columns]

[11]:

libf.tail()

[11]:

| 2014-10-01 | 2014-10-02 | 2014-10-03 | 2014-10-06 | 2014-10-07 | 2014-10-08 | 2014-10-09 | 2014-10-10 | 2014-10-13 | 2014-10-14 | 2014-10-15 | 2014-10-16 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| years | ||||||||||||

| 4.666667 | 2.722915 | 2.686731 | 2.678433 | 2.681385 | 2.639166 | 2.542012 | 2.528768 | 2.489063 | 2.470154 | 2.349732 | 2.372435 | 2.157431 |

| 4.750000 | 2.733588 | 2.697887 | 2.690366 | 2.692824 | 2.650841 | 2.554583 | 2.543066 | 2.502357 | 2.483842 | 2.366052 | 2.387671 | 2.176186 |

| 4.833333 | 2.744126 | 2.708848 | 2.702083 | 2.704147 | 2.662380 | 2.567071 | 2.557216 | 2.515531 | 2.497446 | 2.382298 | 2.402829 | 2.194784 |

| 4.916667 | 2.754540 | 2.719634 | 2.713604 | 2.715368 | 2.673794 | 2.579486 | 2.571229 | 2.528592 | 2.510973 | 2.398468 | 2.417915 | 2.213221 |

| 5.000000 | 2.764842 | 2.730264 | 2.724949 | 2.726501 | 2.685095 | 2.591835 | 2.585117 | 2.541548 | 2.524432 | 2.414562 | 2.432939 | 2.231493 |

[12]:

# generate time index given input data

# starting date + 59 months

date = libf.columns[-1]

index = pd.date_range(date, periods=60, freq='M') # , tz='GMT')

index = [d.replace(day=date.day) for d in index]

index = pd.DatetimeIndex(index)

libf.index = index

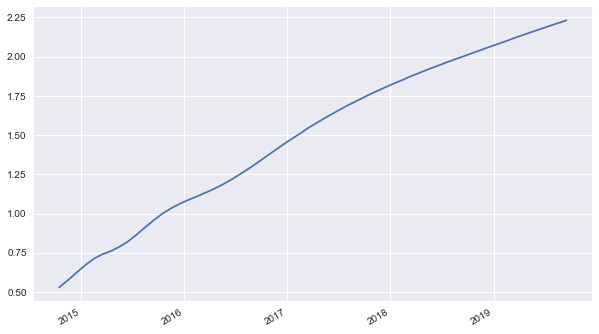

And the short end of the Libor term sturcture visualized.

[13]:

libf.iloc[:, -1].plot(figsize=(10, 6))

[13]:

<matplotlib.axes._subplots.AxesSubplot at 0x10bfe8198>

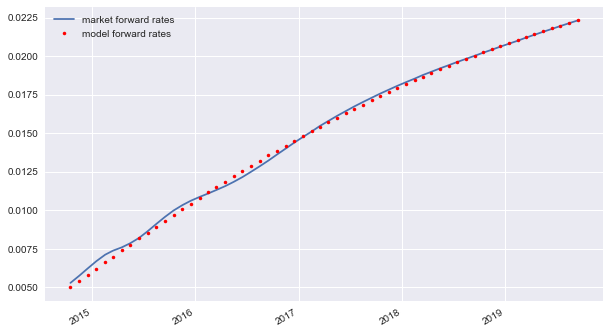

11.3. Model Calibration¶

Next, equipped with the Libor data, we calibrate the square-root diffusion short rate model. A bit of data preparation:

[14]:

t = libf.index.to_pydatetime()

f = libf.iloc[:, -1].values / 100

initial_value = 0.005

A mean-squared error (MSE) function to be minimized during calibration.

[15]:

def srd_forward_error(p0):

global initial_value, f, t

if p0[0] < 0 or p0[1] < 0 or p0[2] < 0:

return 100

f_model = dx.srd_forwards(initial_value, p0, t)

MSE = np.sum((f - f_model) ** 2) / len(f)

return MSE

And the calibration itself.

[16]:

from scipy.optimize import fmin

[17]:

opt = fmin(srd_forward_error, (1.0, 0.7, 0.2),

maxiter=1000, maxfun=1000)

Optimization terminated successfully.

Current function value: 0.000000

Iterations: 371

Function evaluations: 649

The optimal parameters (kappa, theta, sigma) are:

[18]:

opt

[18]:

array([0.00544441, 1.80697228, 0.23689443])

The model fit is not too bad in this case.

[19]:

plt.figure(figsize=(10, 6))

plt.plot(t, f, label='market forward rates')

plt.plot(t, dx.srd_forwards(initial_value, opt, t), 'r.', label='model forward rates')

plt.gcf().autofmt_xdate(); plt.legend(loc=0)

[19]:

<matplotlib.legend.Legend at 0x10bfbcef0>

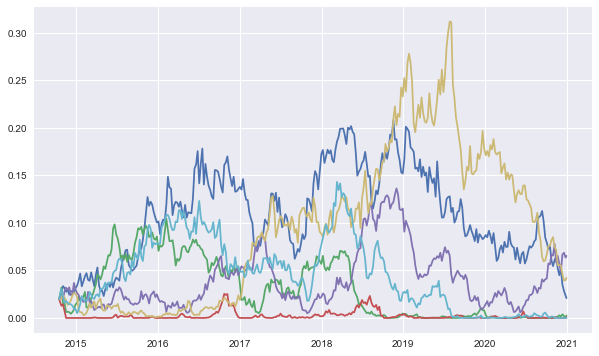

11.4. Floating Rate Modeling¶

The optimal parameters from the calibration are used to model the floating rate (3m Libor rate).

[20]:

# market environment

me_srd = dx.market_environment('me_srd', dt.datetime(2014, 10, 16))

[21]:

# square-root diffusion

me_srd.add_constant('initial_value', 0.02)

me_srd.add_constant('kappa', opt[0])

me_srd.add_constant('theta', opt[1])

me_srd.add_constant('volatility', opt[2])

me_srd.add_curve('discount_curve', ois)

# OIS discounting object

me_srd.add_constant('currency', 'EUR')

me_srd.add_constant('paths', 10000)

me_srd.add_constant('frequency', 'w')

me_srd.add_constant('starting_date', me_srd.pricing_date)

me_srd.add_constant('final_date', dt.datetime(2020, 12, 31))

[22]:

srd = dx.square_root_diffusion('srd', me_srd)

Let us have a look at some simulated rate paths.

[23]:

paths = srd.get_instrument_values()

[24]:

plt.figure(figsize=(10, 6))

plt.plot(srd.time_grid, paths[:, :6])

[24]:

[<matplotlib.lines.Line2D at 0x10ba7de10>,

<matplotlib.lines.Line2D at 0x10c2f6400>,

<matplotlib.lines.Line2D at 0x10c2f6668>,

<matplotlib.lines.Line2D at 0x10c2f6898>,

<matplotlib.lines.Line2D at 0x10c2f6ac8>,

<matplotlib.lines.Line2D at 0x10c2f6cf8>]

11.5. Interest Rate Swap¶

Finally, we can model the interest rate swap itself.

11.5.1. Modeling¶

First, the market environment with all the parameters needed.

[25]:

# market environment for the IRS

me_irs = dx.market_environment('irs', me_srd.pricing_date)

me_irs.add_constant('fixed_rate', 0.01)

me_irs.add_constant('trade_date', me_srd.pricing_date)

me_irs.add_constant('effective_date', me_srd.pricing_date)

me_irs.add_constant('payment_date', dt.datetime(2014, 12, 27))

me_irs.add_constant('payment_day', 27)

me_irs.add_constant('termination_date', me_srd.get_constant('final_date'))

me_irs.add_constant('currency', 'EUR')

me_irs.add_constant('notional', 1000000)

me_irs.add_constant('tenor', '6m')

me_irs.add_constant('counting', 'ACT/360')

# discount curve from mar_env of floating rate

The instantiation of the valuation object.

[26]:

irs = dx.interest_rate_swap('irs', srd, me_irs)

11.5.2. Valuation¶

The present value of the interest rate swap given the assumption, in particular, of the fixed rate.

[27]:

%time irs.present_value(fixed_seed=True)

CPU times: user 198 ms, sys: 82 ms, total: 280 ms

Wall time: 299 ms

[27]:

482804.6280483039

You can also generate a full output of all present values per simulation path.

[28]:

irs.present_value(full=True).iloc[:, :6]

[28]:

| 0 | 1 | 2 | 3 | 4 | 5 | |

|---|---|---|---|---|---|---|

| 2014-12-27 | 20919.908406 | 3765.545880 | -10000.000000 | 20447.662984 | 15671.171542 | -461.905549 |

| 2015-06-27 | 27796.391566 | 67649.371268 | -7952.865109 | 21069.238749 | 6547.642190 | 56254.997722 |

| 2015-12-27 | 72797.267752 | 65085.851729 | -9495.534310 | 7184.517383 | -6249.109421 | 72603.409748 |

| 2016-06-27 | 146587.773739 | 60725.900678 | -9450.695252 | 10630.874710 | 1457.279233 | 96390.826927 |

| 2016-12-27 | 112006.856512 | 11685.574401 | -9365.011855 | 36777.060898 | 40752.233786 | 42437.807055 |

| 2017-06-27 | 89091.008350 | 19143.973791 | -8652.442452 | 10394.933700 | 81112.588234 | 49316.809090 |

| 2017-12-27 | 153802.099096 | 37433.554707 | -2231.031239 | 3046.024441 | 81218.496071 | 89235.982850 |

| 2018-06-27 | 114033.046751 | -4200.273599 | 8204.181410 | 86020.232903 | 92146.494366 | 44010.774119 |

| 2018-12-27 | 165327.788708 | -7186.102024 | -8829.883386 | 46785.300398 | 171037.865434 | 14615.688086 |

| 2019-06-27 | 101110.008932 | -9038.246291 | -6883.724709 | 29794.380064 | 183168.704902 | -4599.638746 |

| 2019-12-27 | 57890.028467 | -8998.424023 | -8573.907447 | 12491.846129 | 151080.678798 | -8960.333669 |

| 2020-06-27 | 95516.235053 | -8968.295497 | -8963.127240 | 15234.994497 | 67282.503413 | -7763.697572 |

| 2020-12-27 | 4651.947620 | -4500.468014 | -6316.280222 | 39899.010233 | 107971.761933 | -8568.679338 |

Copyright, License & Disclaimer

© Dr. Yves J. Hilpisch | The Python Quants GmbH

DX Analytics (the “dx library” or “dx package”) is licensed under the GNU Affero General Public License version 3 or later (see http://www.gnu.org/licenses/).

DX Analytics comes with no representations or warranties, to the extent permitted by applicable law.

http://tpq.io | dx@tpq.io | http://twitter.com/dyjh

Quant Platform | http://pqp.io

Python for Finance Training | http://training.tpq.io

Certificate in Computational Finance | http://compfinance.tpq.io

Derivatives Analytics with Python (Wiley Finance) | http://dawp.tpq.io

Python for Finance (2nd ed., O’Reilly) | http://py4fi.tpq.io