14. Quite Complex Portfolios¶

This part illustrates that you can model, value and risk manage quite complex derivatives portfolios with DX Analytics.

[1]:

from dx import *

import time

from pylab import plt

plt.style.use('seaborn')

%matplotlib inline

np.random.seed(10000)

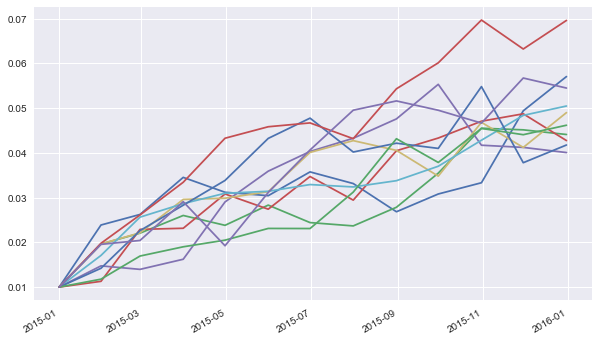

14.1. Multiple Risk Factors¶

The example is based on a multiple, correlated risk factors, all (for the ease of exposition) geometric_brownian_motion objects.

[2]:

mer = market_environment(name='me', pricing_date=dt.datetime(2015, 1, 1))

mer.add_constant('initial_value', 0.01)

mer.add_constant('volatility', 0.1)

mer.add_constant('kappa', 2.0)

mer.add_constant('theta', 0.05)

mer.add_constant('paths', 100) # dummy

mer.add_constant('frequency', 'M') # dummy

mer.add_constant('starting_date', mer.pricing_date)

mer.add_constant('final_date', dt.datetime(2015, 12, 31)) # dummy

ssr = stochastic_short_rate('ssr', mer)

[3]:

plt.figure(figsize=(10, 6))

plt.plot(ssr.process.time_grid, ssr.process.get_instrument_values()[:, :10]);

plt.gcf().autofmt_xdate()

[4]:

# market environments

me = market_environment('gbm', dt.datetime(2015, 1, 1))

[5]:

# geometric Brownian motion

me.add_constant('initial_value', 36.)

me.add_constant('volatility', 0.2)

me.add_constant('currency', 'EUR')

[6]:

# jump diffusion

me.add_constant('lambda', 0.4)

me.add_constant('mu', -0.4)

me.add_constant('delta', 0.2)

[7]:

# stochastic volatility

me.add_constant('kappa', 2.0)

me.add_constant('theta', 0.3)

me.add_constant('vol_vol', 0.5)

me.add_constant('rho', -0.5)

Using 2,500 paths and monthly discretization for the example.

[8]:

# valuation environment

val_env = market_environment('val_env', dt.datetime(2015, 1, 1))

val_env.add_constant('paths', 1000)

val_env.add_constant('frequency', 'M')

val_env.add_curve('discount_curve', ssr)

val_env.add_constant('starting_date', dt.datetime(2015, 1, 1))

val_env.add_constant('final_date', dt.datetime(2016, 12, 31))

[9]:

# add valuation environment to market environments

me.add_environment(val_env)

[10]:

no = 50 # 50 different risk factors in total

[11]:

risk_factors = {}

for rf in range(no):

# random model choice

sm = np.random.choice(['gbm', 'jd', 'sv'])

key = '%3d_%s' % (rf + 1, sm)

risk_factors[key] = market_environment(key, me.pricing_date)

risk_factors[key].add_environment(me)

# random initial_value

risk_factors[key].add_constant('initial_value',

np.random.random() * 40. + 20.)

# radnom volatility

risk_factors[key].add_constant('volatility',

np.random.random() * 0.6 + 0.05)

# the simulation model to choose

risk_factors[key].add_constant('model', sm)

[12]:

correlations = []

keys = sorted(risk_factors.keys())

for key in keys[1:]:

correlations.append([keys[0], key, np.random.choice([-0.1, 0.0, 0.1])])

correlations[:3]

[12]:

[[' 1_sv', ' 2_gbm', 0.1],

[' 1_sv', ' 3_gbm', -0.1],

[' 1_sv', ' 4_gbm', -0.1]]

14.2. Options Modeling¶

We model a certain number of derivative instruments with the following major assumptions.

[13]:

me_option = market_environment('option', me.pricing_date)

# choose from a set of maturity dates (month ends)

maturities = pd.date_range(start=me.pricing_date,

end=val_env.get_constant('final_date'),

freq='M').to_pydatetime()

me_option.add_constant('maturity', np.random.choice(maturities))

me_option.add_constant('currency', 'EUR')

me_option.add_environment(val_env)

14.3. Portfolio Modeling¶

The derivatives_portfolio object we compose consists of multiple derivatives positions. Each option differs with respect to the strike and the risk factor it is dependent on.

[14]:

# 5 times the number of risk factors

# as portfolio positions/instruments

pos = 5 * no

[15]:

positions = {}

for i in range(pos):

ot = np.random.choice(['am_put', 'eur_call'])

if ot == 'am_put':

otype = 'American single'

payoff_func = 'np.maximum(%5.3f - instrument_values, 0)'

else:

otype = 'European single'

payoff_func = 'np.maximum(maturity_value - %5.3f, 0)'

# random strike

strike = np.random.randint(36, 40)

underlying = sorted(risk_factors.keys())[(i + no) % no]

name = '%d_option_pos_%d' % (i, strike)

positions[name] = derivatives_position(

name=name,

quantity=np.random.randint(1, 10),

underlyings=[underlying],

mar_env=me_option,

otype=otype,

payoff_func=payoff_func % strike)

[16]:

# number of derivatives positions

len(positions)

[16]:

250

14.4. Portfolio Valuation¶

First, the derivatives portfolio with sequential valuation.

[17]:

port = derivatives_portfolio(

name='portfolio',

positions=positions,

val_env=val_env,

risk_factors=risk_factors,

correlations=correlations,

parallel=False) # sequential calculation

[18]:

port.val_env.get_list('cholesky_matrix')

[18]:

array([[ 1. , 0. , 0. , ..., 0. ,

0. , 0. ],

[ 0.1 , 0.99498744, 0. , ..., 0. ,

0. , 0. ],

[-0.1 , 0.01005038, 0.99493668, ..., 0. ,

0. , 0. ],

...,

[-0.1 , 0.01005038, -0.01015242, ..., 0.99239533,

0. , 0. ],

[ 0. , 0. , 0. , ..., 0. ,

1. , 0. ],

[ 0.1 , -0.01005038, 0.01015242, ..., 0.01526762,

0. , 0.99227788]])

The call of the get_values method to value all instruments.

[19]:

%time res = port.get_statistics(fixed_seed=True)

Totals

pos_value 10400.2920

pos_delta 116.0584

pos_vega 8477.9800

dtype: float64

CPU times: user 19.8 s, sys: 1.82 s, total: 21.6 s

Wall time: 15.4 s

[20]:

res.set_index('position', inplace=False)

[20]:

| name | quantity | otype | risk_facts | value | currency | pos_value | pos_delta | pos_vega | |

|---|---|---|---|---|---|---|---|---|---|

| position | |||||||||

| 0_option_pos_38 | 0_option_pos_38 | 6 | European single | [ 1_sv] | 7.263 | EUR | 43.578 | 3.6036 | 22.7046 |

| 1_option_pos_39 | 1_option_pos_39 | 8 | American single | [ 2_gbm] | 5.398 | EUR | 43.184 | -3.9168 | 124.5688 |

| 2_option_pos_37 | 2_option_pos_37 | 3 | European single | [ 3_gbm] | 3.306 | EUR | 9.918 | 1.9935 | 42.8949 |

| 3_option_pos_37 | 3_option_pos_37 | 8 | American single | [ 4_gbm] | 9.097 | EUR | 72.776 | -8.0000 | 5.3336 |

| 4_option_pos_39 | 4_option_pos_39 | 1 | European single | [ 5_gbm] | 17.664 | EUR | 17.664 | 0.7531 | 13.4445 |

| 5_option_pos_37 | 5_option_pos_37 | 3 | American single | [ 6_jd] | 13.354 | EUR | 40.062 | -3.0000 | 21.9111 |

| 6_option_pos_36 | 6_option_pos_36 | 9 | European single | [ 7_jd] | 17.651 | EUR | 158.859 | 7.9128 | 41.3010 |

| 7_option_pos_39 | 7_option_pos_39 | 3 | American single | [ 8_gbm] | 9.538 | EUR | 28.614 | -2.9169 | -4.6260 |

| 8_option_pos_36 | 8_option_pos_36 | 4 | American single | [ 9_sv] | 2.584 | EUR | 10.336 | -0.5512 | 5.1040 |

| 9_option_pos_39 | 9_option_pos_39 | 7 | American single | [ 10_sv] | 9.945 | EUR | 69.615 | -3.2571 | -1.2845 |

| 10_option_pos_37 | 10_option_pos_37 | 9 | European single | [ 11_jd] | 13.708 | EUR | 123.372 | 7.4493 | 70.9308 |

| 11_option_pos_38 | 11_option_pos_38 | 1 | European single | [ 12_jd] | 1.247 | EUR | 1.247 | 0.2810 | 8.4409 |

| 12_option_pos_38 | 12_option_pos_38 | 2 | American single | [ 13_sv] | 12.707 | EUR | 25.414 | -1.5630 | -11.0008 |

| 13_option_pos_37 | 13_option_pos_37 | 9 | European single | [ 14_jd] | 21.096 | EUR | 189.864 | 7.2999 | 71.2782 |

| 14_option_pos_36 | 14_option_pos_36 | 3 | American single | [ 15_gbm] | 7.734 | EUR | 23.202 | -1.1520 | 41.3682 |

| 15_option_pos_37 | 15_option_pos_37 | 5 | European single | [ 16_gbm] | 1.636 | EUR | 8.180 | 1.5570 | 51.8430 |

| 16_option_pos_38 | 16_option_pos_38 | 9 | European single | [ 17_jd] | 9.175 | EUR | 82.575 | 5.5710 | 125.4699 |

| 17_option_pos_37 | 17_option_pos_37 | 3 | European single | [ 18_sv] | 14.931 | EUR | 44.793 | 2.3937 | 2.6664 |

| 18_option_pos_39 | 18_option_pos_39 | 6 | European single | [ 19_gbm] | 15.695 | EUR | 94.170 | 4.2756 | 87.2814 |

| 19_option_pos_36 | 19_option_pos_36 | 8 | American single | [ 20_jd] | 12.461 | EUR | 99.688 | -8.0000 | -12.2504 |

| 20_option_pos_39 | 20_option_pos_39 | 8 | American single | [ 21_sv] | 5.136 | EUR | 41.088 | -2.0192 | 61.7368 |

| 21_option_pos_37 | 21_option_pos_37 | 2 | American single | [ 22_sv] | 6.541 | EUR | 13.082 | -0.9288 | 2.7770 |

| 22_option_pos_38 | 22_option_pos_38 | 8 | American single | [ 23_jd] | 1.238 | EUR | 9.904 | -0.3840 | 62.1928 |

| 23_option_pos_39 | 23_option_pos_39 | 6 | American single | [ 24_jd] | 17.719 | EUR | 106.314 | -4.3524 | 58.4406 |

| 24_option_pos_38 | 24_option_pos_38 | 4 | European single | [ 25_jd] | 11.286 | EUR | 45.144 | 3.2148 | 22.3364 |

| 25_option_pos_36 | 25_option_pos_36 | 1 | European single | [ 26_gbm] | 25.986 | EUR | 25.986 | 0.8555 | 11.0891 |

| 26_option_pos_36 | 26_option_pos_36 | 4 | European single | [ 27_jd] | 7.186 | EUR | 28.744 | 3.0756 | 17.4980 |

| 27_option_pos_38 | 27_option_pos_38 | 7 | European single | [ 28_sv] | 0.907 | EUR | 6.349 | 1.5309 | 13.2580 |

| 28_option_pos_37 | 28_option_pos_37 | 8 | European single | [ 29_jd] | 25.429 | EUR | 203.432 | 6.8888 | 103.1016 |

| 29_option_pos_37 | 29_option_pos_37 | 5 | European single | [ 30_gbm] | 12.805 | EUR | 64.025 | 3.4515 | 70.5780 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 220_option_pos_38 | 220_option_pos_38 | 8 | European single | [ 21_sv] | 15.606 | EUR | 124.848 | 6.3080 | 27.5824 |

| 221_option_pos_39 | 221_option_pos_39 | 4 | American single | [ 22_sv] | 7.654 | EUR | 30.616 | -1.6732 | 18.2884 |

| 222_option_pos_38 | 222_option_pos_38 | 4 | European single | [ 23_jd] | 23.064 | EUR | 92.256 | 3.5816 | 10.1348 |

| 223_option_pos_37 | 223_option_pos_37 | 5 | American single | [ 24_jd] | 15.969 | EUR | 79.845 | -3.1480 | 55.6190 |

| 224_option_pos_37 | 224_option_pos_37 | 3 | American single | [ 25_jd] | 2.427 | EUR | 7.281 | -0.4377 | 23.4090 |

| 225_option_pos_39 | 225_option_pos_39 | 2 | European single | [ 26_gbm] | 23.994 | EUR | 47.988 | 1.6648 | 25.6842 |

| 226_option_pos_39 | 226_option_pos_39 | 5 | European single | [ 27_jd] | 5.369 | EUR | 26.845 | 3.5640 | 32.4455 |

| 227_option_pos_37 | 227_option_pos_37 | 1 | American single | [ 28_sv] | 16.571 | EUR | 16.571 | -0.8666 | -8.6498 |

| 228_option_pos_38 | 228_option_pos_38 | 3 | European single | [ 29_jd] | 24.760 | EUR | 74.280 | 2.5620 | 40.4946 |

| 229_option_pos_38 | 229_option_pos_38 | 6 | European single | [ 30_gbm] | 12.399 | EUR | 74.394 | 4.0752 | 86.0244 |

| 230_option_pos_36 | 230_option_pos_36 | 7 | American single | [ 31_sv] | 13.602 | EUR | 95.214 | -5.3767 | 26.1534 |

| 231_option_pos_38 | 231_option_pos_38 | 1 | European single | [ 32_jd] | 9.795 | EUR | 9.795 | 0.7411 | 7.7550 |

| 232_option_pos_39 | 232_option_pos_39 | 1 | American single | [ 33_sv] | 8.961 | EUR | 8.961 | -0.3033 | 10.3389 |

| 233_option_pos_37 | 233_option_pos_37 | 9 | American single | [ 34_jd] | 6.886 | EUR | 61.974 | -2.0682 | 132.4161 |

| 234_option_pos_37 | 234_option_pos_37 | 6 | American single | [ 35_jd] | 2.778 | EUR | 16.668 | -0.6306 | 65.8488 |

| 235_option_pos_37 | 235_option_pos_37 | 4 | American single | [ 36_gbm] | 0.813 | EUR | 3.252 | -0.2988 | 32.4640 |

| 236_option_pos_39 | 236_option_pos_39 | 4 | European single | [ 37_jd] | 0.273 | EUR | 1.092 | 0.8576 | 30.1120 |

| 237_option_pos_37 | 237_option_pos_37 | 9 | American single | [ 38_gbm] | 15.832 | EUR | 142.488 | -8.5698 | 22.3146 |

| 238_option_pos_38 | 238_option_pos_38 | 7 | American single | [ 39_sv] | 9.088 | EUR | 63.616 | -3.9452 | -3.6386 |

| 239_option_pos_39 | 239_option_pos_39 | 6 | European single | [ 40_jd] | 14.955 | EUR | 89.730 | 4.1862 | 72.1008 |

| 240_option_pos_36 | 240_option_pos_36 | 2 | American single | [ 41_jd] | 5.380 | EUR | 10.760 | -0.8410 | 16.4666 |

| 241_option_pos_36 | 241_option_pos_36 | 7 | European single | [ 42_sv] | 6.254 | EUR | 43.778 | 4.3939 | 5.6280 |

| 242_option_pos_38 | 242_option_pos_38 | 1 | American single | [ 43_jd] | 8.108 | EUR | 8.108 | -0.2186 | 16.6002 |

| 243_option_pos_38 | 243_option_pos_38 | 5 | American single | [ 44_jd] | 4.440 | EUR | 22.200 | -1.0505 | 70.7775 |

| 244_option_pos_37 | 244_option_pos_37 | 7 | European single | [ 45_sv] | 12.133 | EUR | 84.931 | 5.1870 | 22.6198 |

| 245_option_pos_36 | 245_option_pos_36 | 5 | European single | [ 46_gbm] | 22.709 | EUR | 113.545 | 4.7900 | -2.6650 |

| 246_option_pos_37 | 246_option_pos_37 | 4 | European single | [ 47_sv] | 2.635 | EUR | 10.540 | 1.5900 | 3.7216 |

| 247_option_pos_39 | 247_option_pos_39 | 3 | American single | [ 48_sv] | 11.420 | EUR | 34.260 | -1.4394 | 6.6159 |

| 248_option_pos_36 | 248_option_pos_36 | 6 | European single | [ 49_gbm] | 0.246 | EUR | 1.476 | 0.6678 | 32.0346 |

| 249_option_pos_36 | 249_option_pos_36 | 5 | American single | [ 50_gbm] | 4.128 | EUR | 20.640 | -1.6095 | 67.1685 |

250 rows × 9 columns

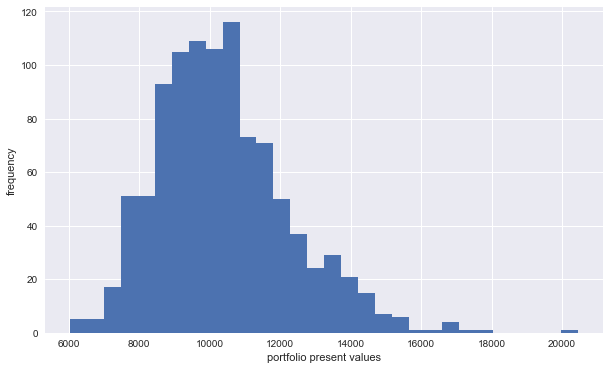

14.5. Risk Analysis¶

Full distribution of portfolio present values illustrated via histogram.

[21]:

%time pvs = port.get_present_values()

CPU times: user 4.61 s, sys: 456 ms, total: 5.07 s

Wall time: 3.52 s

[22]:

plt.figure(figsize=(10, 6))

plt.hist(pvs, bins=30);

plt.xlabel('portfolio present values')

plt.ylabel('frequency')

[22]:

<matplotlib.text.Text at 0x1109aeba8>

Some statistics via pandas.

[23]:

pdf = pd.DataFrame(pvs)

pdf.describe()

[23]:

| 0 | |

|---|---|

| count | 1000.000000 |

| mean | 10385.491824 |

| std | 1891.255451 |

| min | 6045.025829 |

| 25% | 9059.919260 |

| 50% | 10189.486685 |

| 75% | 11436.385373 |

| max | 20446.938649 |

The delta risk report.

[24]:

%%time

deltas, benchmark = port.get_port_risk(Greek='Delta', fixed_seed=True, step=0.2,

risk_factors=list(risk_factors.keys())[:4])

risk_report(deltas)

1_sv

0.8

1.0

1.2

2_gbm

0.8

1.0

1.2

3_gbm

0.8

1.0

1.2

4_gbm

0.8

1.0

1.2

1_sv_Delta

major minor

0.8 factor 28.73

value 10318.88

1.0 factor 35.91

value 10385.48

1.2 factor 43.09

value 10490.80

Name: 1_sv_Delta, dtype: float64

2_gbm_Delta

major minor

0.8 factor 30.36

value 10410.14

1.0 factor 37.95

value 10385.48

1.2 factor 45.54

value 10391.22

Name: 2_gbm_Delta, dtype: float64

3_gbm_Delta

major minor

0.8 factor 30.04

value 10440.04

1.0 factor 37.55

value 10385.48

1.2 factor 45.06

value 10421.06

Name: 3_gbm_Delta, dtype: float64

4_gbm_Delta

major minor

0.8 factor 22.29

value 10429.74

1.0 factor 27.87

value 10385.48

1.2 factor 33.44

value 10351.02

Name: 4_gbm_Delta, dtype: float64

CPU times: user 5.2 s, sys: 502 ms, total: 5.71 s

Wall time: 4 s

The vega risk report.

[25]:

%%time

vegas, benchmark = port.get_port_risk(Greek='Vega', fixed_seed=True, step=0.2,

risk_factors=list(risk_factors.keys())[:3])

risk_report(vegas)

1_sv

0.8

1.0

1.2

2_gbm

0.8

1.0

1.2

3_gbm

0.8

1.0

1.2

1_sv_Vega

major minor

0.8 factor 0.42

value 10377.30

1.0 factor 0.52

value 10384.95

1.2 factor 0.62

value 10402.19

Name: 1_sv_Vega, dtype: float64

2_gbm_Vega

major minor

0.8 factor 0.27

value 10365.33

1.0 factor 0.34

value 10384.95

1.2 factor 0.41

value 10404.53

Name: 2_gbm_Vega, dtype: float64

3_gbm_Vega

major minor

0.8 factor 0.12

value 10374.04

1.0 factor 0.14

value 10384.95

1.2 factor 0.17

value 10395.83

Name: 3_gbm_Vega, dtype: float64

CPU times: user 5.05 s, sys: 481 ms, total: 5.53 s

Wall time: 3.89 s

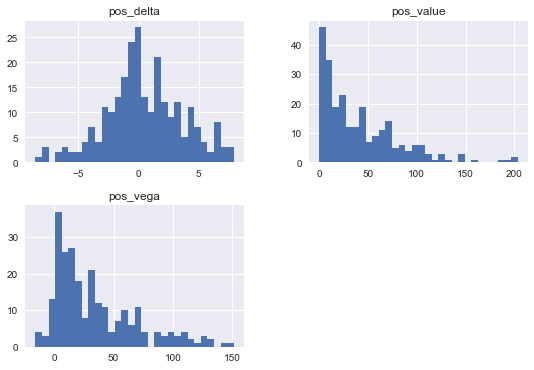

14.6. Visualization of Results¶

Selected results visualized.

[26]:

res[['pos_value', 'pos_delta', 'pos_vega']].hist(bins=30, figsize=(9, 6))

plt.ylabel('frequency')

[26]:

<matplotlib.text.Text at 0x111e61550>

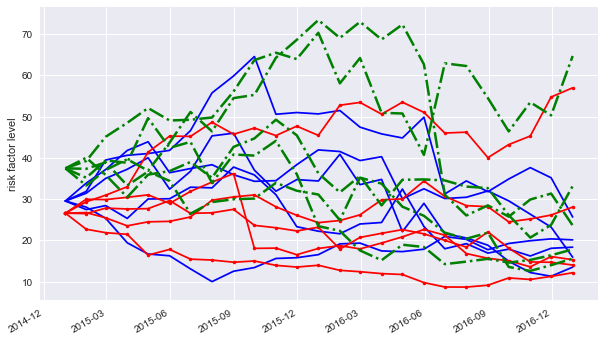

Sample paths for three underlyings.

[27]:

paths_0 = list(port.underlying_objects.values())[0]

paths_0.generate_paths()

paths_1 = list(port.underlying_objects.values())[1]

paths_1.generate_paths()

paths_2 = list(port.underlying_objects.values())[2]

paths_2.generate_paths()

[28]:

pa = 5

plt.figure(figsize=(10, 6))

plt.plot(port.time_grid, paths_0.instrument_values[:, :pa], 'b');

print('Paths for %s (blue)' % paths_0.name)

plt.plot(port.time_grid, paths_1.instrument_values[:, :pa], 'r.-');

print ('Paths for %s (red)' % paths_1.name)

plt.plot(port.time_grid, paths_2.instrument_values[:, :pa], 'g-.', lw=2.5);

print('Paths for %s (green)' % paths_2.name)

plt.ylabel('risk factor level')

plt.gcf().autofmt_xdate()

Paths for 48_sv (blue)

Paths for 12_jd (red)

Paths for 22_sv (green)

Copyright, License & Disclaimer

© Dr. Yves J. Hilpisch | The Python Quants GmbH

DX Analytics (the “dx library” or “dx package”) is licensed under the GNU Affero General Public License version 3 or later (see http://www.gnu.org/licenses/).

DX Analytics comes with no representations or warranties, to the extent permitted by applicable law.

http://tpq.io | dx@tpq.io | http://twitter.com/dyjh

Quant Platform | http://pqp.io

Python for Finance Training | http://training.tpq.io

Certificate in Computational Finance | http://compfinance.tpq.io

Derivatives Analytics with Python (Wiley Finance) | http://dawp.tpq.io

Python for Finance (2nd ed., O’Reilly) | http://py4fi.tpq.io